The shares of IREN Limited (IREN), the Sydney-based data center infrastructure company, are in a downward spiral. IREN stock tumbled over 5% during early trading on Wednesday, escalating the 7% loss seen the previous day.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

These trends reverse the stock’s upward trajectory seen earlier this month and in the preceding month. But why is this happening?

British Columbia Eyes Power Allocation Shakeup

On Monday, Canada’s British Columbia government announced plans for AI and data center companies to start bidding for access to electrical power, beginning in January next year, according to the Canadian Broadcasting Corporation.

Adrian Dix, the provincial government’s energy minister, revealed that while AI companies will have access to 300 megawatts of power, data center businesses will have to slug it out for fixed 100 megawatts available every two years. The proposed policy, if implemented, will reverse the current first-come, first-served basis for granting access.

The plan also includes a recommendation to make permanent British Columbia’s ban on cryptocurrency connections — that is, access to the electrical grid provided to digital asset mining operations. Dix argued that the goal of both moves is to prioritize natural resources and manufacturing initiatives to serve the best interests of the province’s residents.

The policy focus touches on IREN’s areas of operation.

How Will the New Policy Play Out for IREN?

IREN operates in Australia and Canada as a vertically integrated business, owning and operating both its data centers and the computing hardware behind them — such as graphics processing units (GPUs) and servers. The company also operates its own electrical infrastructure, including power and cooling systems.

While IREN continues to mine Bitcoin, the company has been shifting its focus to its AI cloud service business to meet elevated demand for high-performance cloud computing from Big Tech companies. IREN even recently raised $1 billion in debt financing to expand its working capital, among other goals.

Roth Capital analyst Darren Aftahi believes that the new development will not affect IREN. The five-star analyst noted that IREN has 180 megawatts of capacity, giving it leverage over new market entrants.

Aftahi, therefore, raised his price target on IREN stock to $82 per share, representing almost 50% upside.

Is IREN a Good Stock to Buy?

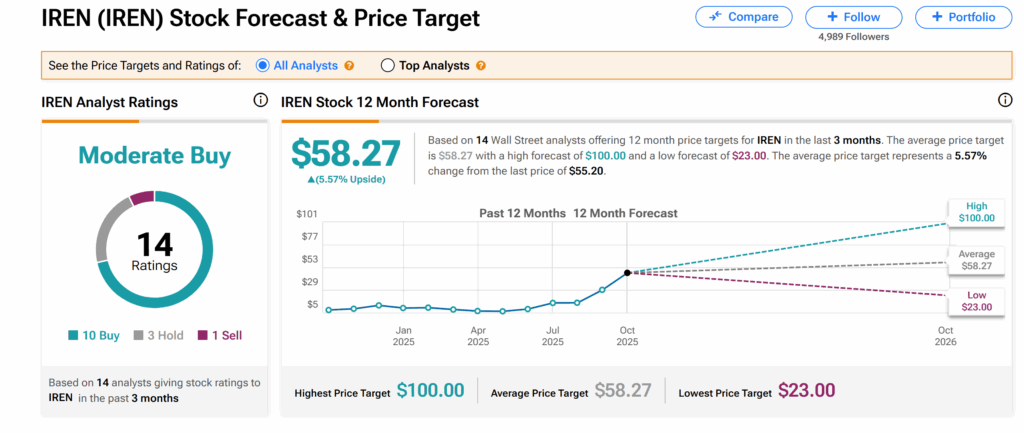

Meanwhile, the larger Wall Street remains cautious about IREN’s shares, with the analyst consensus rating still at Moderate Buy. This is based on 10 Buys, three Holds, and one Sell assigned by 14 analysts over the past three months.

Moreover, the average IREN price target of $58.27 indicates approximately 6% upside potential from the current level.