iQIYI (NASDAQ:IQ) shares dropped nearly 5% in the pre-market session today after the Chinese online entertainment video services provider announced its third-quarter results. Revenue increased by 7% year-over-year to $1.1 billion and was in line with estimates. Further, net income per American Depository Share (ADS) increased to $0.61 from $0.21 in the year-ago period.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Additionally, the company’s operating income ballooned to $102.4 million, marking an over 100% increase in its operating margin. This performance was driven by IQ’s strong content portfolio and offerings such as membership privilege.

The company is also benefitting from operating leverage, with its average daily number of total subscribing members rising to 107.5 million from 101 million in the year-ago period. Furthermore, its monthly average revenue per membership (ARM) ticked higher to RMB 15.54 from RMB 13.90 a year ago. At the end of the quarter, IQ had a cash pile of nearly $980.9 million.

Is IQ Stock a Good Buy?

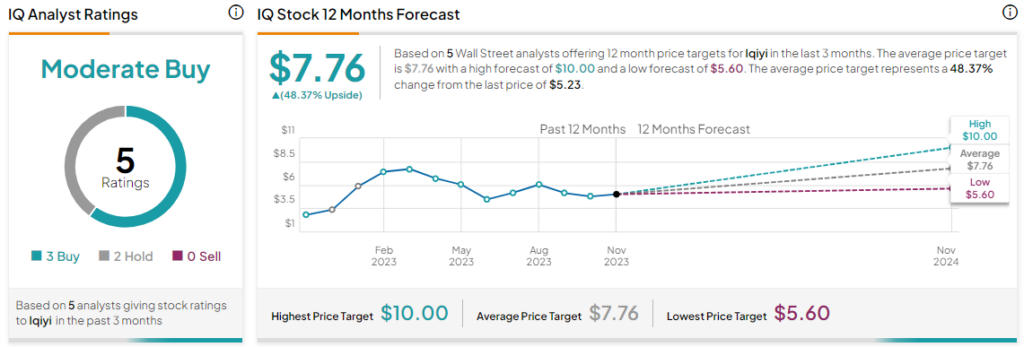

Overall, the Street has a Moderate Buy consensus rating on iQIYI, and the average IQ price target of $7.76 implies a mouth-watering 48.4% potential upside. Impressively, that’s on top of the 84% jump in the company’s shares over the past year.

Read full Disclosure