Q3 earnings season is heating up, and IonQ (IONQ) and D-Wave Quantum (QBTS) are two quantum computing stocks drawing close investor attention. Both have gained momentum in 2025 as interest in next-generation computing and AI-driven technologies continues to rise. IonQ is a key player in quantum hardware and cloud-based systems backed by Amazon (AMZN) and Microsoft (MSFT), while D-Wave Quantum is widening its reach in applied quantum computing with growing demand for its annealing-based tools in optimization and logistics.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With both companies set to report their Q3 earnings soon, investors are watching closely to see which quantum computing stock could deliver stronger gains.

IonQ (NYSE:IONQ) Stock

IonQ stock has gained 46% year-to-date, supported by steady progress in its quantum hardware and international expansion. Earlier this month, the company set a world record for two-qubit gate fidelity at 99.99%, marking another step forward in quantum performance. Shares also moved higher after IonQ joined the Q-Alliance in Italy’s Lombardy region, part of the country’s plan to build a stronger base for quantum research.

In a separate update, IonQ announced a $2 billion stock offering to fund its next phase of growth and boost its cash reserves ahead of its upcoming quarterly results. Investors are now watching to see if these steps can help the company turn its technical progress into stronger sales and profits.

Looking ahead, IONQ is scheduled to report its Q3 2025 earnings on November 5. Analysts expect a loss per share of $0.44, compared to a $0.24 loss in the same period last year, while revenue is expected to increase 118% year-over-year to $26.99 million.

D-Wave Quantum (NYSE:QBTS) Stock

D-Wave Quantum stock has surged 280% so far this year, supported by rising interest in quantum computing and its real-world business uses. Earlier this month, the company signed a €10 million deal with Swiss Quantum Technology SA to deploy its Advantage2 annealing quantum computer in Europe, marking an important step in its international expansion. In another update, D-Wave announced plans to redeem all outstanding public warrants by November 19, 2025. This could help reduce dilution and simplify its share structure.

Looking ahead, QBTS is scheduled to report its Q3 2025 earnings on November 6. Analysts expect a loss of $0.07 per share, slightly better than a $0.072 loss in the same quarter last year. Meanwhile, revenue is expected to reach $3.04 million, up about 63% year-over-year.

Investors are watching to see if these recent moves can help D-Wave grow sales, attract more customers, and strengthen its cash flow in a sector that still requires heavy investment in new technology.

Analysts Remain Bullish on Both Quantum Stocks Ahead of Q3 Results

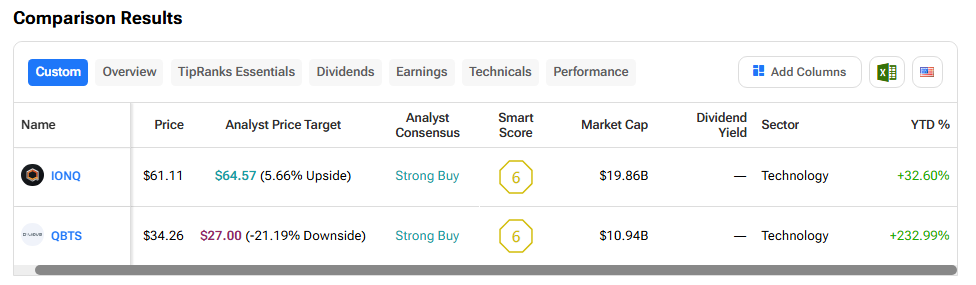

Using TipRanks’ Stock Comparison Tool, we compared IonQ and QBTS to see which quantum computing stock analysts favor. Both stocks carry a Strong Buy rating and share a Smart Score of 6.

IonQ has an average analyst price target of $64.57, pointing to a modest 5.66% upside from current levels. In comparison, D-Wave Quantum’s average target of $27.00 indicates a possible 21% downside.