The U.S. economy appears to have avoided a hard-landing scenario, prompting investors to consider readjusting their portfolio holdings for what appears to be a soft-landing scenario. Market watchers use the term soft landing when the Federal Reserve achieves a necessary economic slowdown after the economy has been flying high. Notably, high-flying economies increase demand, which invites inflation.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Historically, strong economic activity has often led to the Fed implementing tight monetary policies, such as raising interest rates, which can end up crashing the economy. Such a crash or hard landing is not intentional but is normal and, for the most part, expected.

It appears the Fed has effectively managed economic controls, increasing the likelihood of a soft landing. This suggests the need for potential adjustments to investment portfolios.

Winners and Losers with a Soft Landing

Any helpful portfolio adjustment revolves around picking winners and getting rid of losers. On the winning side, potential beneficiaries in a healthy economy are industries that would have done poorly if the Fed overreacted and rates were prematurely lowered. Notably, the Fed typically responds to undesirable economic weakness by lowering interest rates.

One of the sectors that benefits from a long period of stable economic growth is the financial industry. Financial companies tend to do well in a growing environment where rates are modestly stable. Investors may look at the current stable economic outlook and opt to increase their holdings in financial companies.

On the losing side, the areas where investors may look to reduce exposure could be high-dividend stocks, which performed strongly in anticipation of lower bond yields but may now weaken. Investors can also add real estate investments to the list of sectors that struggle when rates stay high.

Financial Companies in the Spotlight

Large banks are just a couple of days away from reporting earnings for the first quarter, which places financial companies in the spotlight. In a soft landing scenario, financial companies are expected to do well because of their broad exposure across the economy. A growing economy could mean more business for financial institutions, no matter where the growth is coming from.

The following large financial companies have a broad stake in the U.S. economy and may benefit if rates aren’t volatile. The companies are scheduled to provide first-quarter results soon. In the absence of any bad surprises in the quarterly results, these three companies are representative of those expected to benefit if the Fed has indeed orchestrated a scenario where inflation continues to moderate, while jobs and business activity remain good.

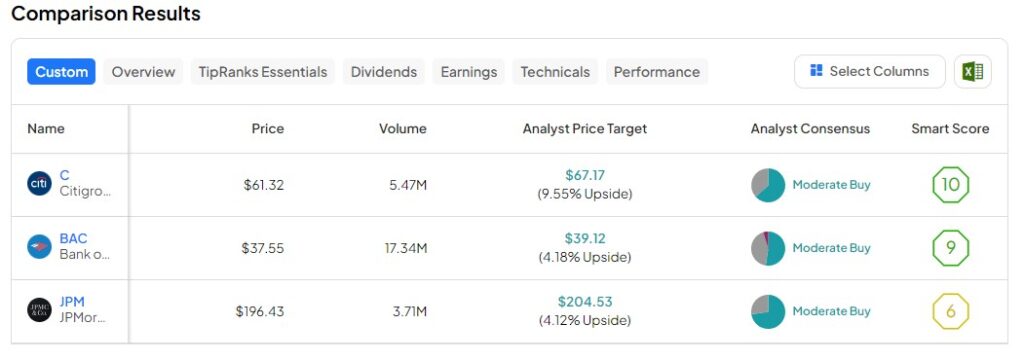

JPMorgan Chase & Co. (NYSE:JPM) is one of the largest financial institutions in the U.S. The company plans to report its first-quarter results on the morning of Friday, April 12th. Citigroup (NYSE:C), along with Bank of America (NYSE:BAC), are expected to report their earnings results for the first quarter of 2024 on Tuesday, April 16th, before the markets open.

The TipRanks Comparison Tool is an excellent way to discover what the consensus is among experts regarding these financial institutions and others. This tool allows you to compare them and gain insights into analysts’ perspectives.

Takeaways

A soft landing won’t impact all investments equally. Financial companies play a crucial role in the economy, facilitating the flow of capital and providing essential services to businesses and consumers. In a soft landing scenario, financial companies are likely to benefit from the more gradual slowing of the economy because businesses and consumers will continue to require financial services to support their own growth and stability.