Shares of DraftKings Inc. (NASDAQ: DKNG), a $15.1-billion sports entertainment and gaming company, grew 9.8% to close at $17.96 on Friday after it posted upbeat second-quarter results and increased guidance for 2022.

DraftKings’ losses in the quarter were 49.3% narrower than the consensus estimate, and its sales exceeded the Street’s estimate by 6.3%.

A Snapshot of DraftKings’ Q2 Results

In the quarter, the company reported a loss per share of $0.38 per share, compared with the consensus estimate of $0.75 per share. Its adjusted loss stood at $0.29 per share in the second quarter of 2022 and $0.26 per share in the second quarter of 2021.

Revenues were $466.2 million, up from the consensus estimate of $438.6 million. Also, the top line increased 56.6% year-over-year, driven by a 68.3% increase in revenues of the B2C segment. However, sales of the B2B segment declined 58.2% year-over-year.

It is worth mentioning that average monthly unique payers (MUPs) increased 36.4% year-over-year, while average revenue per MUP advanced 28.8% in the second quarter.

The increase in revenues was more than offset by higher costs and expenses. Costs of revenues in the second quarter grew 67.2% and operating expenses advanced 7% year-over-year.

Loss from operations in the quarter amounted to $308.9 million from $321.6 million in the year-ago quarter. The adjusted earnings before interest, tax, depreciation and amortization (EBITDA) were ($118.1) million versus ($95.3) million in the second quarter of 2021.

In addition to losses in the quarter, the company’s cash positions weakened, compared with the 2021-end. Cash and cash equivalents at $1,514.4 million were down 29.7% from the 2021-end. This included the impact of net cash flow of ($529.3) million from operating activities, $14.5 million spent on capital expenditure, $96.5 million cash paid for acquisitions, and $17.5 million used for purchasing treasury stocks.

DraftKings’ Projections for 2022 Are Impressive

For 2022, DraftKings forecasts revenues to be within the $2.08-$2.18 billion range, higher than the $2.055-$2.175 billion estimated earlier. The revised expectation reflects a 60% to 68% rise from the previous year.

Also, the company forecasts adjusted EBITDA to be within the ($765)-($835) million range versus the ($810)-($910) million range stated previously.

DraftKings’ Co-Founder, CEO, and Chairman of the Board, Jason Robins, said, “Due to our ongoing investments in core online gaming technologies, we are in a strong position from a competitive perspective as we approach the beginning of the NFL season. We remain well capitalized, ready to enter new markets as they become live, and confident in our ability to compete and win with customers.”

Website Traffic Hinted at DraftKings’ Top-Line Strength

According to TipRanks, total visits to DraftKings’ website are forecast to have increased by 47.7% year-over-year in the second quarter of 2022. The uptick in the traffic mirrors the company’s top-line prospects. Learn how Website Traffic can help you research your favorite stocks.

Is DraftKings a Buy or Sell?

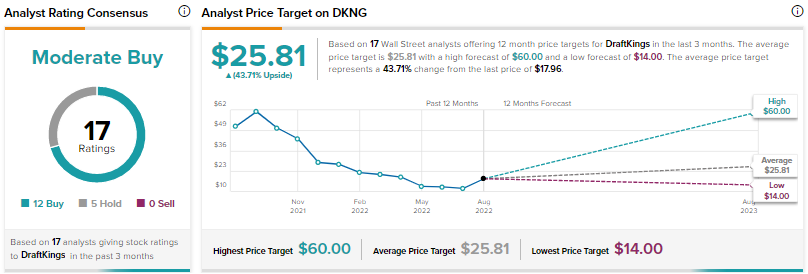

DraftKings could be a good investment option for long-term investors. On TipRanks, the company has a Moderate Buy consensus rating based on 12 Buys and five Holds.

The company’s top-line prospects are solid, evident from its upbeat second-quarter performance and increased sales projections for 2022. Also, effective management of its costs and expenses would help improve the company’s performance in the quarters ahead.

DKNG’s average price forecast of $25.81 suggests 43.71% upside potential from the current level. Considering the upside potential, long-term investors could use the current low prices to gain exposure to DKNG stock, which has lost 35.3% year-to-date.

Read full Disclosure