Earnings reports mean big things for stocks. So too do outlooks. Just ask Cloudflare (NYSE:NET), which saw a fifth of its market cap evaporate in just one day’s trading thanks to an outlook that scared investors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Cloudflare offered a poor outlook not just for the next quarter but for the entire year as well. Revenue for the second quarter of 2023 is expected between $305 million and $306 million. Analysts, however, were looking for $320 million, which is a pretty substantial difference. The outlook only got worse for the full year, as Cloudflare targeted revenue between $1.28 billion and $1.284 billion. That’s down substantially from what Cloudflare forecast just weeks ago at $1.33 billion to $1.34 billion.

The problem, as noted by Thomas Seifert, Cloudflare’s CFO, is the sales cycle. It’s taking businesses longer to place orders and to renew previous orders. That is likely to continue being a problem for the rest of the year. That was an assessment echoed by Jefferies analyst Brent Thill, who noted that macro conditions only got worse for Cloudflare and that businesses were increasingly delaying deals to perform more analysis on the deals in question. Delays in collection also hurt, as did slower expansion.

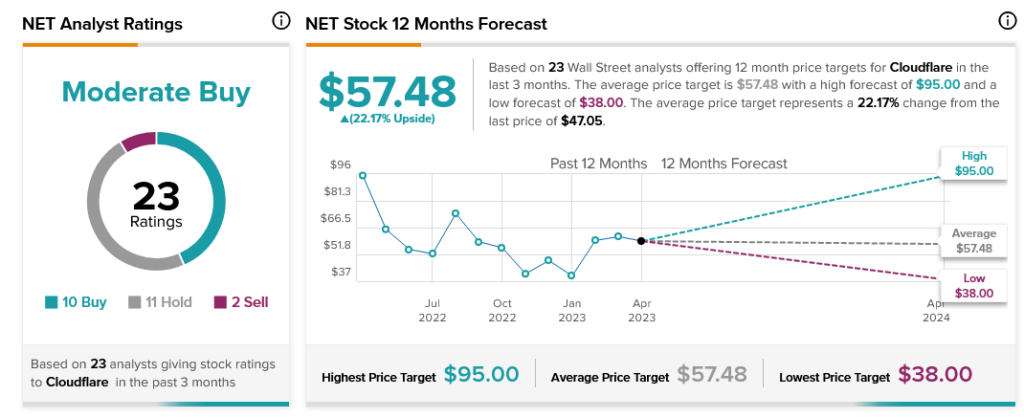

Analysts are somewhat split about Cloudflare’s future. Cloudflare stock is currently regarded as a Moderate Buy, thanks to 10 Buy ratings, 11 Holds, and two Sells. With an average price target of $57.48, Cloudflare stock offers 22.17% upside potential.