The stock of Intuit (INTU) is up 8% after the business software company reported Fiscal third-quarter financial results that beat Wall Street targets across the board.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company behind software programs such as TurboTax and QuickBooks announced earnings per share (EPS) of $11.65, which topped the $10.93 consensus expectation of analysts. Revenue in the quarter totaled $7.75 billion, which was ahead of the $7.57 billion forecast on Wall Street.

Management said the strong results were due to robust sales of its business software products during the recently completed tax season. In the same period last year, Intuit posted earnings of $9.88 a share on revenue of $6.73 billion.

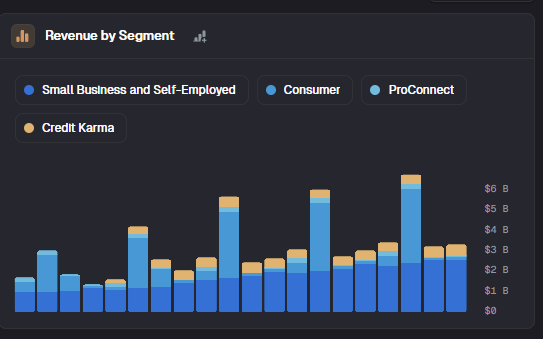

Inuit’s revenue by segment. Source: Main Street Data

Raised Outlook

In addition to the strong print, Intuit also raised its full-year guidance, saying it now expects earnings of $20.07 to $20.12 per share. That implies growth of approximately 18% to 19%, up from previous guidance that called for growth of 13% to 14%. The company’s outlook is also above Wall Street estimates of $19.40 a share.

As for revenue, Intuit is now estimating sales growth of about 15%, forecasting a range of $18.72 billion to $18.76 billion. That outlook us up from previous guidance that called for 12% revenue growth. Analysts had been looking for full-year sales of $18.37 billion from the company.

INTU stock is up 6% this year.

Is INTU Stock a Buy?

The stock of Intuit has a consensus Strong Buy rating among 21 Wall Street analysts. That rating is based on 20 Buy and one Hold recommendations assigned in the last three months. The average INTU price target of $726.80 implies 9.12% upside from current levels. These ratings are likely to change after the company’s financial results.