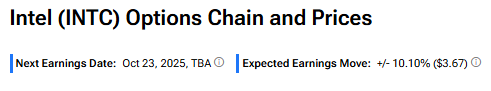

Intel (INTC) is set to report its Q3 earnings on Thursday, October 23, and the options market is hinting at a potentially volatile reaction. Traders are pricing in a 10.1% move in either direction following the results, reflecting uncertainty about the chipmaker’s turnaround efforts and semiconductor demand. Interestingly, the potential swing is much larger than INTC’s long-term average post-earnings move of -2.78%, which reflects a modest decline.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The expected move reflects investors’ focus on Intel’s turnaround progress and its ability to balance large investments in chip factories with disciplined cost control. Also, the market is looking forward to any update on how well the company is catching up to rivals AMD (AMD) and Nvidia (NVDA) in high-performance computing.

Importantly, a strong outlook could drive bullish momentum, while cautious comments by the company’s management might trigger a selloff.

Expectations From INTC’s Q3 Results

Wall Street is expecting INTC to report earnings of $0.02 per share, against a loss of $0.46 per share in the year-ago quarter. Also, analysts project revenues of $13.16 billion, up 0.8% from the same quarter last year. The company is expected to have benefited from a modest recovery in PC demand and increasing traction in AI and data center businesses.

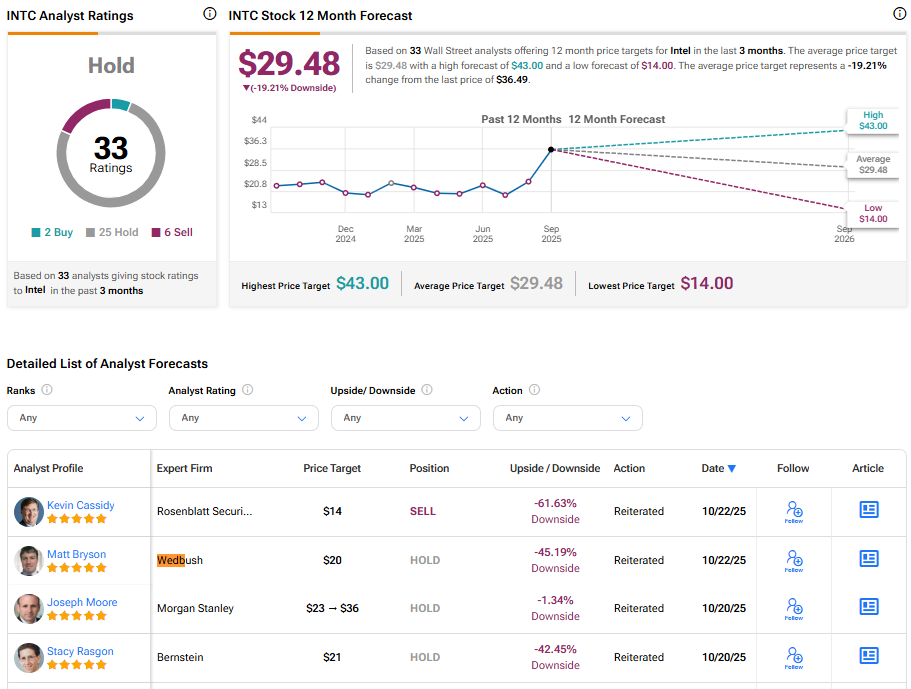

Ahead of the Q3 results, Wedbush analyst Matt Bryson raised his price target on Intel stock to $20 from $19 but kept a Hold rating. The analyst is cautious about the stock’s recent jump in valuation. At the same time, he expects Intel’s upcoming Q3 results and outlook to show signs of improvement.

Is INTC Stock a Buy, Sell, or Hold?

With two Buy, 25 Hold, and six Sell recommendations, Wall Street has a Hold consensus rating on Intel stock. The average INTC stock price target of $29.48 indicates a downside risk of 19.14% from current levels.