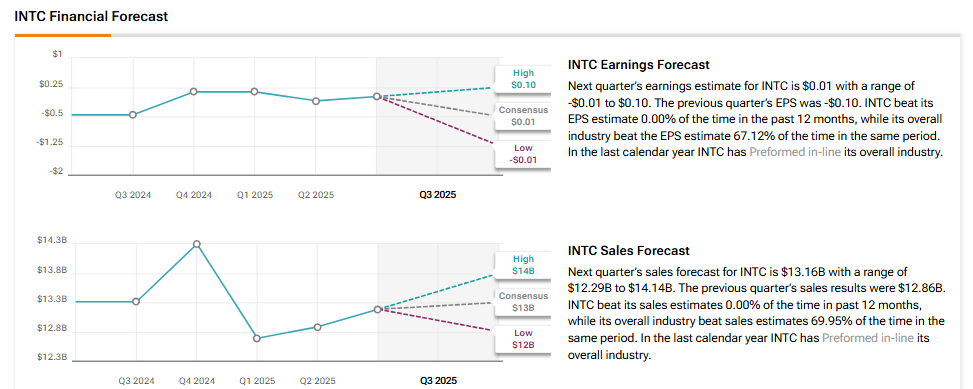

Chip giant Intel Corporation (INTC) is scheduled to announce its results for the third quarter of 2025 after the market closes on Thursday, October 23. INTC stock has risen over 90% so far this year, driven by several major deals, including a $2 billion investment from SoftBank (SFTBY) and a new CPU partnership with Nvidia (NVDA), which have helped restore investor confidence in the company. However, Intel’s foundry business remains a concern, due to production delays and uncertainty over its next-generation chip technology. Meanwhile, analysts expect Intel to report earnings per share of less than $0.01, versus a loss of $0.46 per share in the year-ago quarter.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Revenues are expected to increase modestly by 0.8% from the year-ago quarter to $13.16 billion, according to data from the TipRanks Forecast page.

Investors will look forward to management’s updates on the progress made on the cost reduction front, the impact of tariffs, and progress on product roadmaps, especially for AI chips.

Top KeyBanc Analyst Weighs in on Intel’s Upcoming Earnings

Heading into Q3 results, KeyBanc analyst John Vinh reaffirmed a Hold rating with a price target of $35.00 per share. Vinh, a 5-star analyst, expects stronger third-quarter results and higher guidance for the fourth quarter, supported by rising demand for servers and customer upgrades to Intel’s new Granite Rapids chips. He noted that public cloud companies have been adopting Granite Rapids more actively in recent months.

Vinh added that server demand remains healthy in the second half of the year, helped by upgrades to next-generation CPUs from both Intel and AMD (AMD). For 2025, he forecasts server shipments to grow about 4% year over year.

However, Vinh noted that Intel’s foundry progress is facing delays, with manufacturing yields for its Intel 18A process still around 50–55%. This shortfall could postpone large-scale production of its Panther Lake chips until the second quarter of 2026.

Options Traders See Large Movement in INTC Stock on Q3 Earnings

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting about a 10.28% move in either direction in Intel stock in reaction to Q3 results.

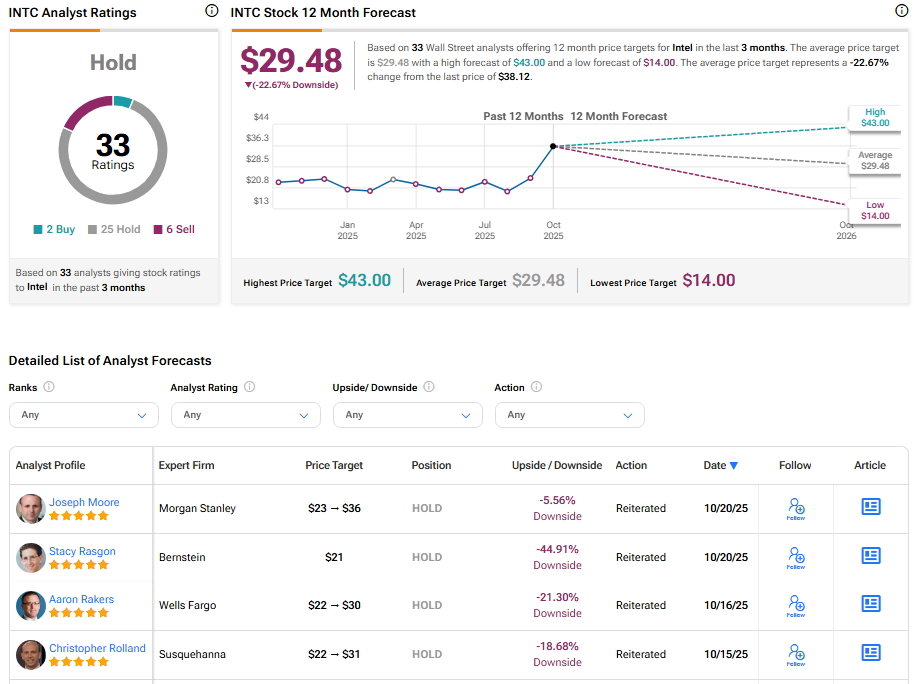

Is INTC Stock a Buy, Sell, or Hold?

With 25 Holds, six Sells, and two Buy recommendations, Wall Street has a Hold consensus rating on Intel stock. The average INTC stock price target of $29.48 indicates a possible downside of 22.67% from current levels.