Recently, chip stock Intel (INTC) got together with two other major names in the field—Super Micro Computer (SMCI) and Micron (MU)—to produce something impressive: the STAC-M3 benchmark, a system which has impressive potential in generating and using trading strategies. Intel’s part in this was mostly infrastructure, but the results spoke for themselves. And investors spoke too, and loudly. Intel shares surged over 6% in Tuesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The three firms brought together an advance in the STAC-M3 benchmark, which is intended to provide an edge in high-frequency quantitative trading. Delivering better performance on this front can generate a direct improvement in trading profits, so for Intel to have a hand in this is, undoubtedly, welcome.

Supermicro supplied its Petascale servers, and Micron brought its 9550 solid-state drives along with DDR5 memory. Intel kicked in the Xeon 6 processors, a move which should help give Intel’s processors a brand-new credibility in the market. That is something Intel very much needs right now, considering how much market share Intel has lost to its various competitors over the last few years.

Why Lip-Bu Tan Got Involved

Meanwhile, Intel’s newest CEO, Lip-Bu Tan, got more personally involved, revealing why he had joined Intel to begin with. He noted that his plan was to “refocus” the chipmaker, putting a particular emphasis on engineering. Intel had “…too many layers of management,” Tan revealed, and set about flattening the company’s org chart, as well as removing large portions of it altogether.

In the place of all that management, Tan has focused on advancing Intel’s position in artificial intelligence—which had been lagging the market for quite some time—as well as improving the foundry business, which received quite a bit in the way of investment, but did not deliver much in return. At least, not yet.

Is Intel a Buy, Hold or Sell?

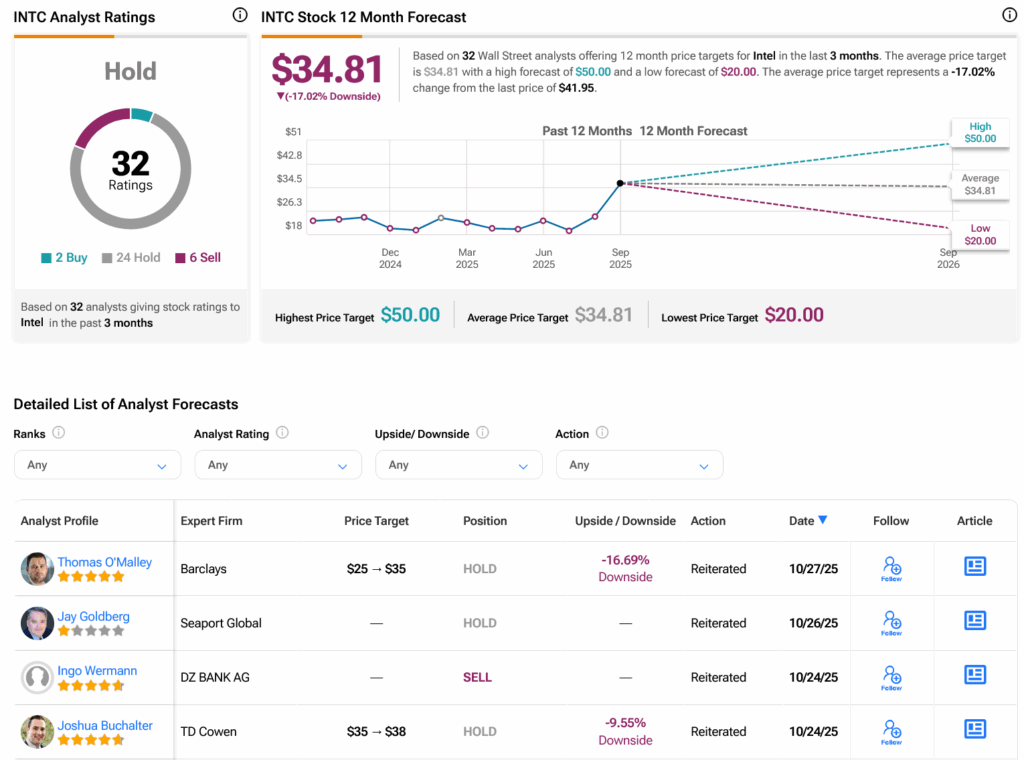

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on two Buys, 24 Holds and six Sells assigned in the past three months, as indicated by the graphic below. After a 72.66% rally in its share price over the past year, the average INTC price target of $34.81 per share implies 17.02% downside risk.