Chip stock Intel (INTC) has been in the middle of a comeback mode for months now, and much of Intel’s hope these days lies on its foundry operations to bring in a lot of new revenue to justify the massive spending that started only recently. And some look to the advanced packaging operations as the perfect way to not only bring back Intel, but also give the United States a new edge in chip production. This proved oddly inspirational to investors, who sent shares launching up over 3% in Monday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Intel’s efforts in making semiconductor nodes have been a bit hit-or-miss in the past, to the point where even it outsourced some chip manufacturing functions to competitors. But now, Intel may be able to turn things around in a big way thanks to a focus on advanced packaging. Currently, some of Intel’s biggest competitors, like Taiwan Semiconductor (TSM), can produce 4 nm wafers. But the wafers need to be shipped back to Taiwan for packaging.

But a little under two years ago, reports note, Intel started quietly doing something about that. It augmented its New Mexico operations to include advanced packaging operations. Now, with Fab 9 and Fab 11x both able to handle advanced packaging, Intel has put both chip and packaging together in the same country, which makes for more efficient processing and a potential edge over its competitors.

Far From Over

And while this is certainly good news for Intel, the news is incomplete, and far from settled. Intel’s recent earnings report demonstrated that the comeback seemed to be working. But working is not worked, and that means more distance to travel overall.

The problem seems to be that the manufacturing segment has not brought in sufficient revenue to make up for the expenses it has incurred so far. And while there are hopes that it will, there is certainly a case that it will not. The foundry sector narrowed its losses, but narrowed is not removed, so Intel has a ways to go yet before it can truly claim victory.

Is Intel a Buy, Hold or Sell?

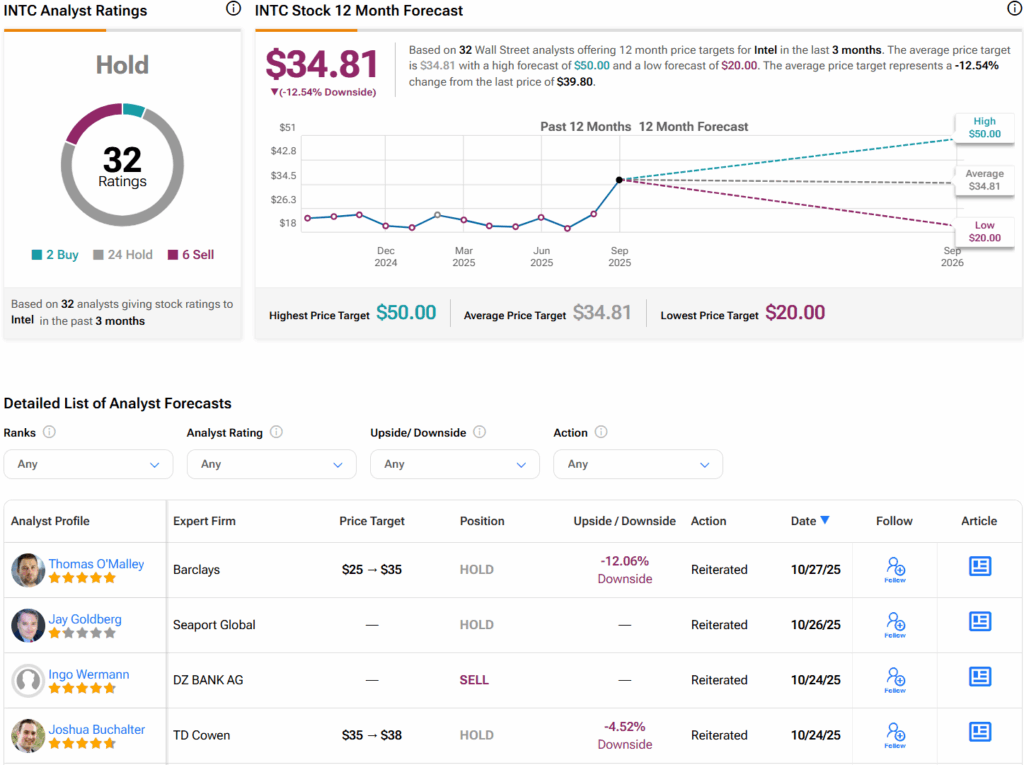

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on two Buys, 24 Holds and six Sells assigned in the past three months, as indicated by the graphic below. After a 67.02% rally in its share price over the past year, the average INTC price target of $34.81 per share implies 12.54% downside risk.