Intel (NASDAQ:INTC) and Tower Semiconductor (NASDAQ:TSEM), two of the biggest names in chip stocks, recently set up a new agreement to work together on foundry functions and get more done in the same space. Investors were of mixed opinion in Tuesday afternoon’s trading, with Intel up modestly and Tower down fractionally.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Previously, Intel tried to purchase Tower and incorporate those functions into its own operations. But the deal fell through, and now, Intel’s trying to pick up some of the pieces and get it back up and running. Intel will offer up its New Mexico production operations to not only serve as a foundry but also in producing 300mm manufacturing. Tower, meanwhile, will put up $300 million in cash to “…acquire and own equipment and other fixed assets” to augment the New Mexico operation.

With demand surging for 300mm chips, the extra production capacity would be deeply welcome for Tower, and by extension, for Intel. Adding New Mexico’s production to the mix would give Tower access to “over 600,000 photo layers per month” in chip construction capacity. Though we’ve been hearing quite a bit about a reduced demand for chips of late, there is a wide variety of chips out there. Being able to produce more helps ensure that another chip shortage—like the one we saw only recently—will be abated accordingly.

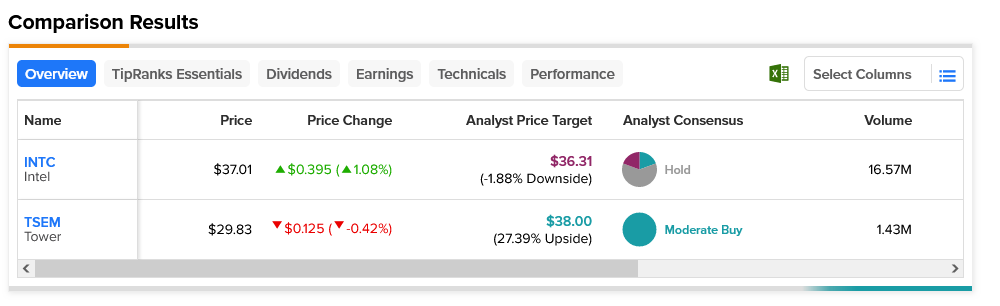

The two stocks, meanwhile, offer very different levels of opportunity for investors. Intel stock, for its part, is rated a Hold by analyst consensus and offers investors a 1.88% downside risk on the strength of a $36.31 average price target. Meanwhile, Tower stock comes with a 27.39% upside potential thanks to its average price target of $38 and is considered a Moderate Buy by analyst consensus.