Semiconductor giant Intel Corporation (NASDAQ:INTC) is set to become an anchor investor in chip-designing rival Arm’s initial public offering (IPO), slated for the end of the year. Softbank Group (OTC:SFTBY)-owned Arm Ltd. is a leading chip designer that caters to world-class chipmakers, including Intel itself, Advanced Micro Devices (NASDAQ:AMD), and Nvidia (NASDAQ:NVDA). Its designs are used in everything from networking chips to processors to smartphone chips.

U.K.-based Arm seeks to raise between $8 and $10 billion in its Nasdaq listing, making it one of the biggest IPOs of the year. Having said that, Arm’s valuation has not been finalized yet, and reports suggest it could be valued anywhere between $30 and $70 billion. The details of the deal between Intel and Arm are unknown at the moment. Further, there are also chances of the listing falling apart altogether once the regulatory diligence is carried out. Softbank’s earlier effort to sell Arm Ltd. to Nvidia was terminated due to regulatory pressures last year, after which the Japanese firm decided to proceed with an IPO for Arm.

An anchor investor is usually an institutional investor who buys a large chunk of shares in a company at a fixed price before its IPO. An anchor investor’s interest in the IPO intrigues the interest of the other investors and attracts them to the listing. Intel CEO Patrick Gelsinger said the company is making this commitment to show its openness to changing times. Intel even hopes to draw outsourcing orders from other chip makers to strengthen its position in the competitive chip industry.

Is Intel a Good Long-Term Investment?

Wall Street analysts prefer to remain on the sidelines with Intel stock. On June 7, Bernstein analyst Stacy Rasgon maintained a Hold rating on INTC with a price target of $30, implying 9.3% downside potential from current levels. Also, overall, Intel has a Hold consensus rating on TipRanks, based on five Buys, 17 Holds, and four Sell ratings. The average Intel price forecast of $30.84 implies 6.7% downside potential.

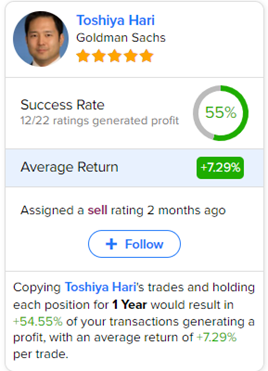

Further, investors looking for the most profitable analyst for INTC could follow Goldman Sachs analyst Toshiya Hari. Copying the five-star analyst’s trades on this stock and holding each position for one year could result in 55% of your transactions generating a profit, with an average return of 7.29% per trade.