Sometimes, you just have to wonder what shareholders actually want. For chip stock Intel (NASDAQ:INTC), it should have been an easy case for gains as it recently participated in an industry-first event. But shareholders thought otherwise and sent shares down over 1.5% in Thursday afternoon’s trading.

In this case, Intel got together with ASML Holding (NASDAQ:ASML), the Dutch lab famous for its chip-making processes. The two assembled the first-ever High Numerical Aperture Extreme Ultraviolet lithography (NA EUV) system, a process that will make Intel even more of a powerhouse in the chip sector than it already is.

With a High NA EUV system in place, Intel will be able to produce chips to a level of precision previously unseen in the industry, and can scale upward rapidly. The system isn’t up and running yet; it’s currently at the D1X test manufacturing operation in Oregon, awaiting final calibration and eventual use.

Susquehanna Lowered Intel’s Price Target

While this is big news and should have been much more exciting for shareholders, there was a less satisfactory development. Susquehanna announced, attributed to no single analyst, that it was lowering its price target on Intel from $42 to $40 per share. However, it kept its Neutral rating in place.

Reports note that Intel’s numbers on client shipments were looking solid enough, but there was “…a noted weakness in Server segments ahead of new product launches slated for the second half of the year.” This does likely suggest a comeback in the making later on, though right now, the picture is a bit weak.

Is Intel a Buy, Sell, or Hold?

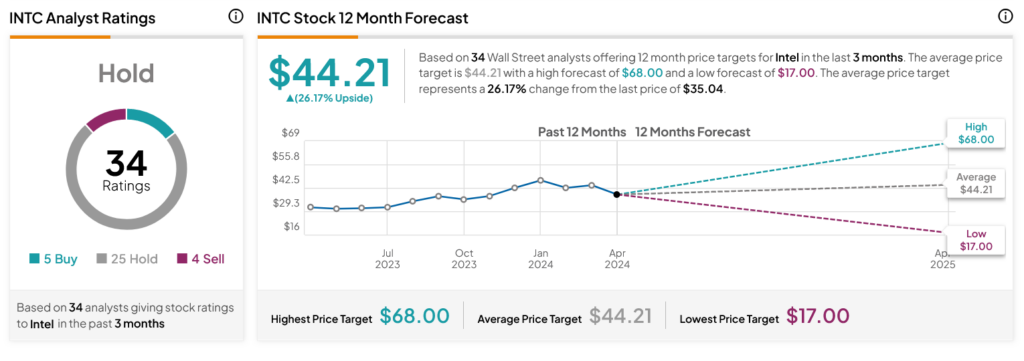

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on five Buys, 25 Holds, and four Sells assigned in the past three months, as indicated by the graphic below. After a 14.32% rally in its share price over the past year, the average INTC price target of $44.21 per share implies 26.17% upside potential.

Intel also pays out a quarterly dividend, which yields 1.38%. This is above the technology sector (XLK) average of 1.025%.

Is INTC the Right Stock to Buy for Passive Income?

Before you hurry to invest in INTC, think about the following:

TipRanks’ team has built a Smart Dividend Stock Portfolio for investors, and Intel is not included. Our portfolio highlights companies that have been hand-picked for their potential to deliver significant passive income for years to come.