Semiconductor company Intel (NASDAQ:INTC) bypassed export restrictions to ship chips worth hundreds of millions of dollars to the heavily sanctioned Chinese tech and telecom company Huawei, Reuters reported. This move, allowing Intel to supply chips for use in laptops to Huawei, has been termed as unfair by its rival, Advanced Micro Devices (NASDAQ:AMD).

The report highlighted that Intel’s share of chip sales to Huawei increased significantly between 2020 and 2023, while AMD’s share declined. This was because the United States Department of Commerce had granted special permissions to some American suppliers of Huawei, including Intel, to sell specific items to it in 2020. However, AMD’s attempt to obtain a license to sell similar chips under President Joe Biden’s administration did not receive any response.

Currently, President Biden is under pressure to revoke the license issued by the Trump administration, which permitted Intel to continue shipping chips to Huawei.

Export Ban Hurts Semiconductor Companies

While INTC bypassed restrictions to sell chips to Huawei, its overall sales in China dipped in 2023 due to the export ban. Notably, China is an important market for Intel, as revenue from billings to China accounts for 27% of its overall sales. In 2023, Intel reported sales of $14.85 billion in China, down over 13% year-over-year.

Meanwhile, AMD’s sales in China (including Hong Kong) fell over 34% in 2023. Also, Nvidia’s (NASDAQ:NVDA) leadership said during the Q4 conference call that the data center revenue was strong across all regions, except for China, where it declined significantly following the U.S. government export control regulations.

What is the Prediction for Intel Stock?

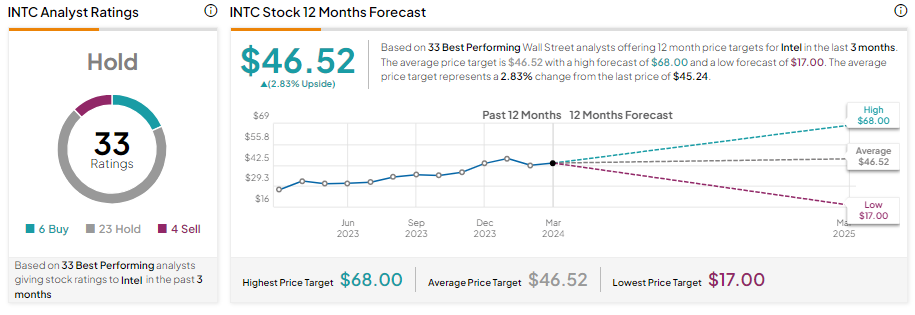

Intel stock has gained over 70% in one year, benefitting from artificial intelligence (AI)-led tailwinds and an expected recovery in the PC market. However, analysts remain sidelined on INTC stock due to heightened competition.

INTC stock has six Buy, 23 Hold, and four Sell recommendations for a Hold consensus rating. Analysts’ average price target on INTC stock is $46.52, implying an upside potential of 2.83% from current levels.