Intel (NASDAQ:INTC) and IBM (NYSE:IBM) are two old-school tech plays that have lived through the rise and fall of the dot-com bust that happened nearly a quarter century ago. Undoubtedly, Intel and IBM were the stars of their day, and though other tech titans — think the Magnificent Seven — have taken their place, I still feel that the two old-school tech plays are worth a second look as they look to take the artificial intelligence (AI) ball and run with it.

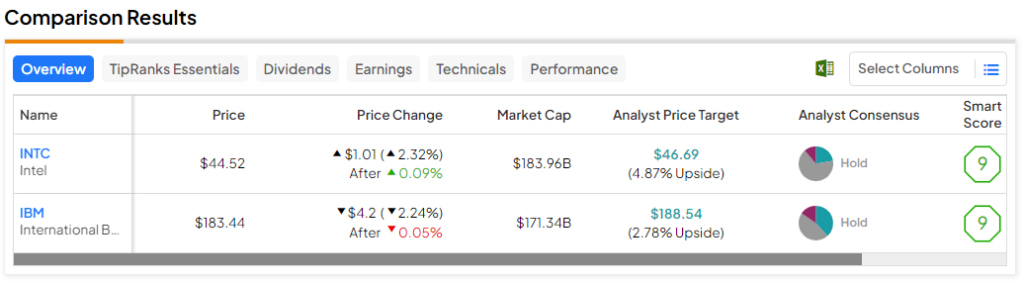

Therefore, let’s check in with TipRanks’ Comparison Tool and see where Wall Street analysts stand on the two AI-savvy legacy firms going into March 2024. And, perhaps more importantly, how much does each firm stand to benefit as they place their bets on the rise of generative AI, a trend that only seems to get more impressive (and terrifying) with time?

Indeed, it’s hard to believe that this is basically the worst AI will be. In such an uncertain and tech-savvy future, the following “dinosaurs” of the tech scene may just be able to turn AI into a growth lever to bring them back to the spotlight.

Intel (NASDAQ:INTC)

Intel used to be the semiconductor top dog in the glory days of CPUs. Remember the Intel ads and the “Intel Inside” stickers? The very best PCs had to have them if they were to be considered anything close to being at the top of the line. Nowadays, Intel has lost its dominance as a slew of new rivals swooped in. To add even more insult to injury, various mega-cap tech firms have chosen to build their own systems on a chip (SoC).

With the rise of accelerated computing and the generative AI age, I think Intel is an underdog that we can’t yet count out the game — not with CEO Pat Gelsinger running the show with his plans to bring Intel back to the forefront. With a modest valuation relative to peers, I’m not against betting on Intel stock (in fact, I am bullish), even if it may be playing from behind in key categories.

As we gravitate from PCs to so-called “AI PCs,” as Intel likes to call them, the firm actually stands to win back a chunk of users. Indeed, AI features are the heart of the AI PC generation, and with the Falcon Shores chip (coming next year), Intel hopes to narrow the gap with some of its rivals in the AI chip scene.

Although Intel may have fallen a tad behind the times, I am confident the firm has what it takes to become a force in the age of AI-capable PCs. The company remains as ambitious as ever, with hopes to have the “best CPU and the best GPU” in the market.

Though I wouldn’t get my hopes up that high as an investor (that’ll just set you up for colossal disappointment, given Intel’s profoundly powerful rivals), I believe Intel has room to gain if Falcon Shores can keep up with the pack as firms continue to back up the truck on AI chips. AI is a profound technology, and Intel certainly stands out as a lesser-appreciated “pick and shovels” play at this juncture as other investors overlook its plans in favor of its better-performing competitors.

Only time will tell how Falcon Shores will stack up in 2025, a year that’s sure to be full of profound AI advances. Either way, the stock looks cheap with a 0.53 five-year PEG ratio, miles below that of the semiconductor industry average (3.3).

In the meantime, look for Intel to keep investing heavily in its fabrication facilities. Reportedly, Intel is seeking $2 billion to build its Irish chip plant, a move that shows Intel’s seriousness about catching up.

What Is the Price Target for INTC Stock?

INTC stock is a Hold, according to analysts, with eight Buys, 24 Holds, and four Sells assigned in the past three months. The average INTC stock price target of $46.69 implies 4.9% upside potential.

IBM (NYSE:IBM)

IBM stock is looking attractive again after powering to multi-year highs on the back of solid quarterly sales growth (up 4%) and some impressive free cash flow guidance (a whopping $12 billion for 2024). The main star of the show (as you guessed it) was AI and its potential to propel the legacy company to the modern era.

While IBM stock is not the hottest AI play in the market right now (far from it, actually), it’s hard to place a bet against the old-school tech play as it shows off some of its AI muscles. All things considered, I remain bullish on the name.

It’s not just AI growth that has me upbeat about the firm; IBM seeks to build a generative AI product that’s responsible, even trustworthy. Undoubtedly, whenever one uses a chatbot, their data and privacy are on the line. And let’s not forget about chatbot “hallucinations,” whereby a bot may unintentionally serve up misinformation.

With IBM’s “responsible AI” focus and intriguing ethics-focused managers, I view the firm as a potential AI underdog that could shock us all as it looks to return to glory after years of standing in the shadows of the bigger innovators that pulled ahead of it. IBM is back, and it may be time to give the firm the benefit of the doubt.

What Is the Price Target for IBM Stock?

IBM stock is a Hold, according to analysts, with five Buys, six Holds, and two Sells assigned in the past three months. The average IBM stock price target of $188.54 implies 2.8% upside potential.

The Takeaway

Legacy tech titans are innovating with AI, and that may be their “golden ticket” to higher highs and more relevance in the new generation. Of the two, analysts see more gains to be had from Intel for the year ahead. I’m inclined to agree; Intel stock looks like the better bet, with its clear path forward and a new, potentially impactful chip (Falcon Shores) due 2025.