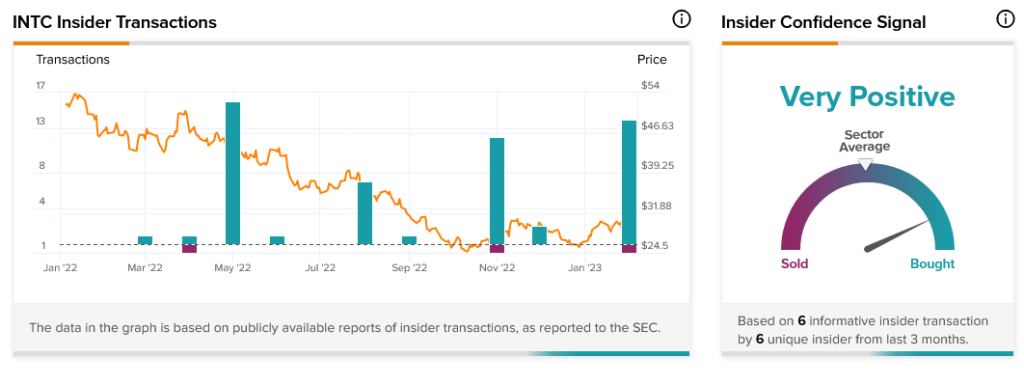

Here’s an unexpected twist: some of Intel’s (NASDAQ:INTC) biggest insiders recently bought in heavily on its stock. A sudden burst of insider trading does suggest some possibilities, and Intel’s insider trading is no different. Intel turned positive in Friday afternoon trading, but what’s going on with this stock?

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

INTC appreciated after Pat Gelsinger, the firm’s CEO, and David Zinsner, its CFO, purchased substantial amounts of stock in recent trading. Gelsinger dropped a cool quarter-million, picking up 9,000 shares at an average price of $27.83 per share. Zinsner, meanwhile, spent $251,000 for 9,050 shares, averaging a slightly lower $27.78 each.

These purchases come at an unusual time for Intel. Not only did it recently turn in a catastrophe of an earnings report, but it also delivered pay cuts throughout the organization. These cuts were progressive, as Gelsinger himself took a 25% pay cut, while mid-level employees took 5% pay cuts. With suggestions that AMD (NASDAQ:AMD) is eating Intel’s lunch on several fronts, now might look like a bad time to buy in on the company.

That’s not what insiders seem to think, though. Gelsinger and Zinsner weren’t alone in their purchases. In the last three months, Intel insiders have purchased a combined $3.4 million worth of stock. Gelsinger and Zinsner only account for $501,000 of that, so it’s clear there’s more going on here. Right now, insider sentiment at Intel is Very Positive, despite everything that’s happened so far. It looks right now like the insiders are planning for a turnaround.