Shares of Intel (NASDAQ:INTC) plunged in after-hours trading after the company reported earnings for its fourth quarter of Fiscal Year 2022. Earnings per share came in at $0.10, which missed analysts’ consensus estimate of $0.21 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sales decreased by 28.2% year-over-year, with revenue hitting $14 billion. This missed analysts’ expectations of $14.49 billion.

Looking forward, management now expects revenue for Q1 2023 to be in the range of $10.5 billion to $11.5 billion and adjusted earnings per share of -$0.15. For reference, analysts were expecting $14.02 billion in revenue along with an adjusted EPS of $0.25.

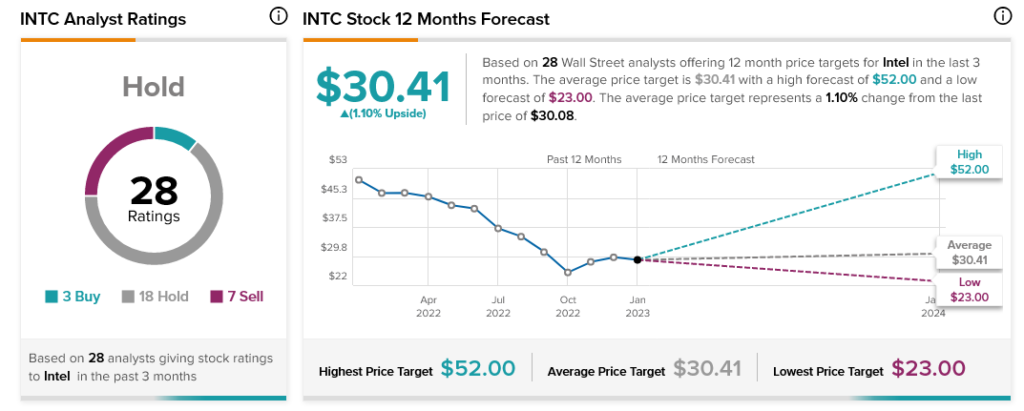

Overall, Wall Street has a consensus price target of $30.41 on Intel stock, implying 1.1% upside potential, as indicated by the graphic above.