One of Super Micro Computer’s (NASDAQ:SMCI) directors, Shiu Leung Chan, recently bought 2,000 shares of the company at a weighted average price of $568 per share. The total transaction value stands at $1.14 million. It is worth mentioning that SMCI stock gained 14% on Monday and hit a new 52-week high of $670. Furthermore, the stock rose another 2.5% at the time of writing.

The company provides high-performance server solutions and advanced technology innovations for enterprise, cloud, and data center environments.

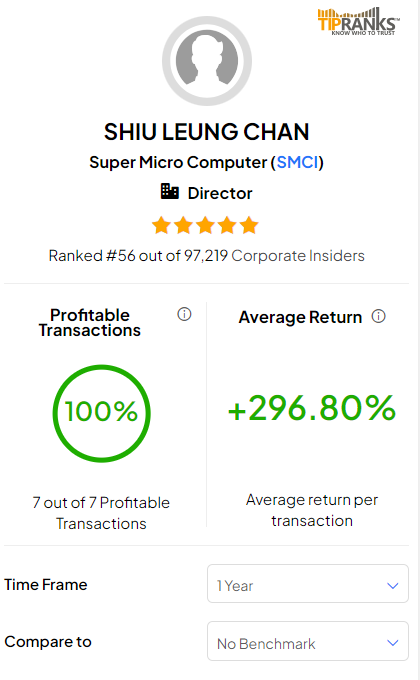

The total value of SMCI stock in Chan’s portfolio currently stands at $24.9 million. Interestingly, the insider’s overall performance track record shows a 100% success rate over the past year, with an impressive average return of 296.8% per transaction.

Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Recent Updates

It is worth highlighting that the insider initiated the purchase of SMCI shares a week after the company released its better-than-expected second-quarter results. Further, the company raised its Fiscal 2024 revenue outlook to between $14.3 billion and $14.7 billion from its prior estimate of $10 billion to $11 billion.

Following the earnings release on January 29, SMCI received four Buys and one Hold rating from Wall Street analysts.

Is SMCI a Good Stock to Buy?

Overall, on TipRanks, Super Micro has a Moderate Buy consensus rating based on four Buys, one Hold, and one Sell rating. After an impressive rally of over 697% over the past year, the average SMCI stock price target of $551 per share implies a 16.94% downside potential from current levels.

Discover the insider trading tool driving results for investors