Shares of Staar Surgical (NASDAQ:STAA) gained about 4% on Friday’s extended trading session after a top insider, Broadwood Partners L.P., disclosed the purchase of STAA stock worth $6.48 million. It is important to highlight that Broadwood Partners is the owner of more than 10% of Staar’s shares. STAA is a manufacturer of implantable lenses and delivery systems used in ophthalmic surgery.

As per the SEC filing, the insider bought 226,553 shares of the company in multiple transactions between January 3 and January 5, at an average price of $28.60 per share.

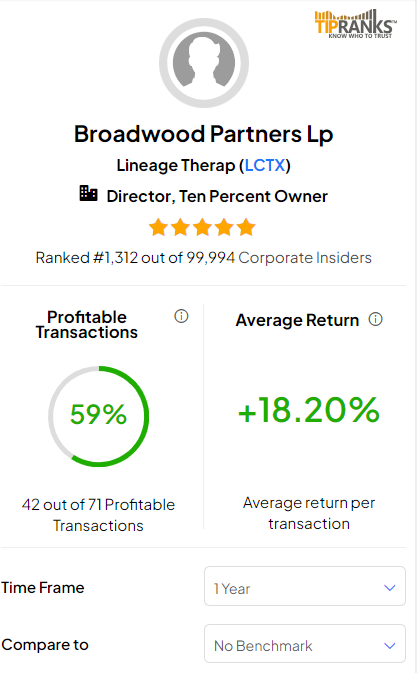

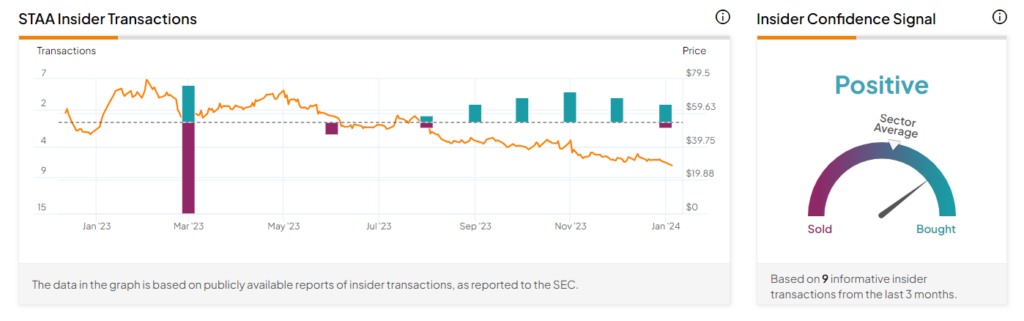

Interestingly, the firm has been on a buying spree of STAA stock since September 2023. The total value of the stock in Broadwood Partners’ portfolio currently stands at $613.5 million. It is worth mentioning that the insider’s overall performance track record shows a 59% success rate over the past year, with an impressive average return of 18.2% per transaction.

Bullish Insider Trading Signal

Overall, corporate insiders have bought Staar Surgical stock worth $41.8 million over the last three months. TipRanks’ Insider Trading Activity Tool shows that insider confidence in Staar is currently Positive.

TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is STAA a Good Stock to Buy?

Following the insider’s purchase, two analysts reiterated a Hold rating on STAA stock. One of the analysts is Thomas Stephan from Stifel Nicolaus, who lowered the price target on Staar Surgical to $30 from $35.

On TipRanks, STAA has a Hold consensus rating based on two Buys and seven Holds. The average Staar Surgical stock price target of $43.17 implies 51.7% upside potential. The stock is down more than 29% over the past three months.