One of Mirum Pharmaceuticals (NASDAQ:MIRM) directors and more than 10% owner, Patrick Heron, recently undertook a huge buy transaction. This biopharmaceutical company develops treatments for rare liver diseases.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As per the SEC filing, Heron bought 147,991 shares of MIRM stock on August 31 at an average price of $26.25 per share. The total value of the transaction stands at $3.88 million. After the latest purchase, the total value of his holdings in MIRM stock now stands at about $98.22 million.

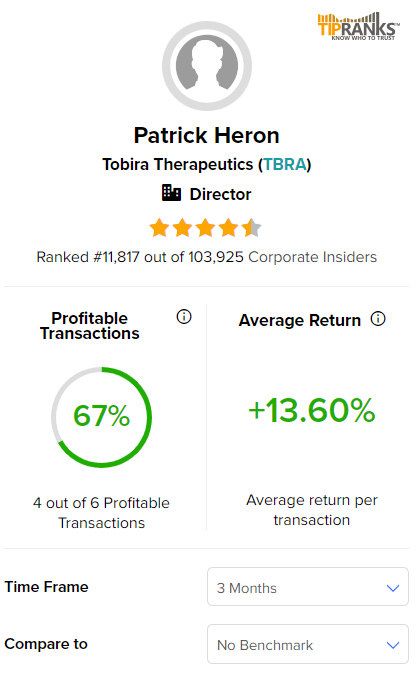

As per the data collected by TipRanks, Heron has had a success rate of 67% in his six transactions over the past three months, with an average return of 13.6% per transaction.

Investors could keep close track of these notable insider activities, as they reflect the perception of key insiders about the company’s future prospects.

Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Recent Development

Mirum has successfully completed the acquisition of Travere Therapeutics’ (TVTX) bile acid product portfolio. The deal encompasses two medications, Cholbam and Chenodal, designed to address rare diseases in critical times.

The deal bolstered Mirum’s position in the rare liver disease sector by adding two more commercial products to its portfolio.

Is MIRM Stock a Good Buy?

Overall, MIRM stock has a Strong Buy consensus rating on TipRanks based on five unanimous Buy recommendations. The average price target of $54 implies a 95.51% upside potential. The stock has gained about 43% so far in 2023.

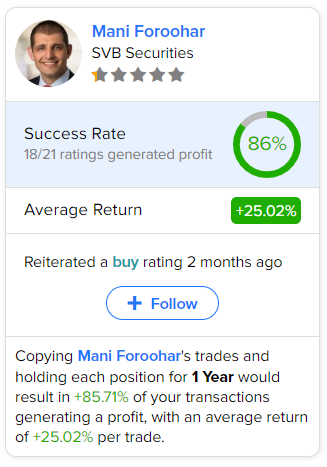

Investors looking for the most accurate and profitable analyst for Mirum could follow SVB Securities analyst Mani Foroohar. Copying the analyst’s trades on this stock and holding each position for one year could result in 86% of your transactions generating a profit, with an average return of 25.02% per trade.