Insiders have been busy at GameStop (GME) and Foot Locker (FL), snapping up shares in a show of confidence. In this article, we will see if it’s a smart play for investors to follow.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In a series of insider transactions, GameStop directors Alan Attal and Larry Cheng made significant stock purchases on the open market in September. Attal acquired 15,000 GameStop shares for $266,700, bringing his total holdings to 562,464 shares. Cheng purchased 6,000 shares for $105,900 at an average price of $17.65 through a limited-liability company and now owns 55,088 shares. Both had previously invested in GameStop in June. GameStop has grappled with stock fluctuations since terminating CEO Matt Furlong in June.

Is GME a Good Stock to Buy Right Now?

Shares of GameStop have plunged by more than 20% in the past three months. Only one analyst has covered the stock in the past three months and is bearish about the stock.

Foot Locker CEO Loads Up on More Shares

Earlier this month, Foot Locker (FL) CEO Mary Dillon bought 5,510 shares for $100,100, adding to her existing 115,388 shares. Shares of Foot Locker have tumbled this year, down by more than 45%, as a bleak outlook has left investors disappointed.

Tracking insider transactions can be useful for investors as it gives them an idea of how the people who are most in the know about the company are trading. Overall, insiders are positive about Foot Locker, as corporate insiders have bought shares worth more than $100,000 in the past three months.

Should I invest in Foot Locker?

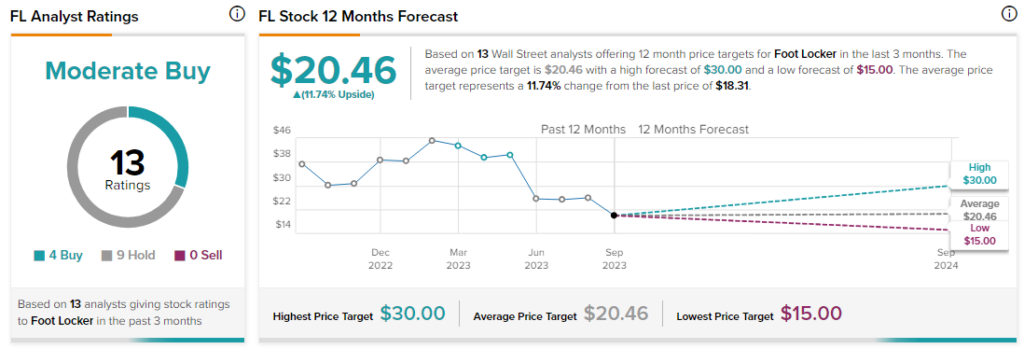

Overall, analysts are cautiously optimistic about FL stock, with a Moderate Buy consensus rating based on four Buys and nine Holds.

Conclusion: Despite Insider Enthusiasm at GameStop, Analysts Prefer Foot Locker

Despite Insider enthusiasm at GameStop, analysts prefer Foot Locker by a wide margin. Indeed, Wall Street sees more than 65% downside risk for GME stock versus an upside potential of more than 11% for FL stock. Therefore, analysts believe that Foot Locker is the smart play.