Foot Locker (NYSE: FL), the specialty athletic retailer cratered in pre-market trading after the retailer’s Q2 revenues, excluding foreign currency exchange fluctuations, fell by 10.2% year-over-year to $1.86 billion. This fell short of Street estimates of $1.88 billion. Moreover, comparable store sales in the second quarter declined by 9.4%.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

More disappointingly, the company lowered its FY23 outlook and now expects sales to decline by 8% to 9% year-over-year versus its previous estimate of a fall of 6.5% to 8% while comparable store sales are likely to drop between 9% and 10%. Foot Locker has projected FY23 adjusted earnings to be in the range of $1.30 to $1.50 per share as compared to its prior guidance between $2.00 and $2.25 per share.

Adjusted Q2 earnings slid to $0.04 per share as compared to $1.10 per share in the same period last year but were in line with Street estimates.

Foot Locker has hit a pause on its dividends “to increase balance sheet flexibility in support of longer-term strategic priorities” after its recently-approved dividend payout on October 27 to holders of record on October 13.

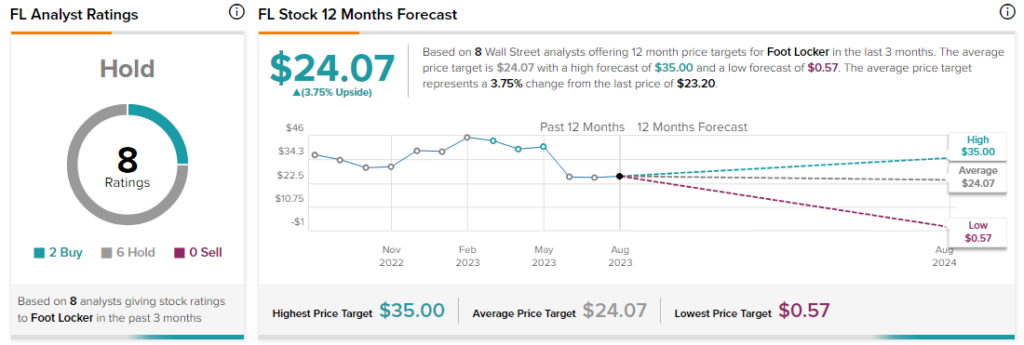

Analysts remained sidelined about FL stock with a Hold consensus rating based on two Buys and six Holds.