Shares of Axalta Coating Systems (NYSE:AXTA) gained 2.3% in yesterday’s extended trade after one of its directors disclosed the purchase of AXTA’s shares. The company manufactures coatings for light and commercial vehicles, industrial, and refinish applications.

Axalta’s Director Kevin Stein, a key corporate insider, bought 36,500 shares of the company on September 6 at a weighted average price of $27.38 per share. The transaction’s total value stands at $1 million.

It is worth mentioning that Stein’s appointment to Axalta’s Board of Directors became effective on September 1, 2023.

As per the data collected by TipRanks, Stein has witnessed a 60% success rate in the past three months. Further, he has been able to generate an average return of 2.4% per transaction.

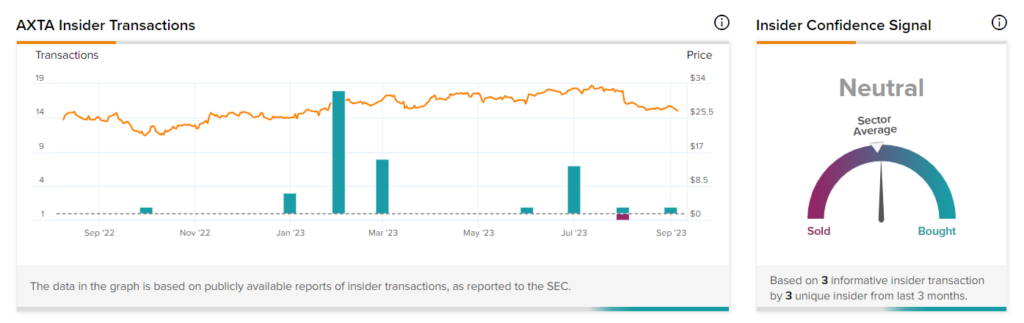

Neutral Insider Confidence Signal

Overall, corporate insiders have bought AXTA shares worth $1.5 million over the last three months. TipRanks’ Insider Trading Activity Tool shows that insider confidence in Axalta is currently Neutral.

Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

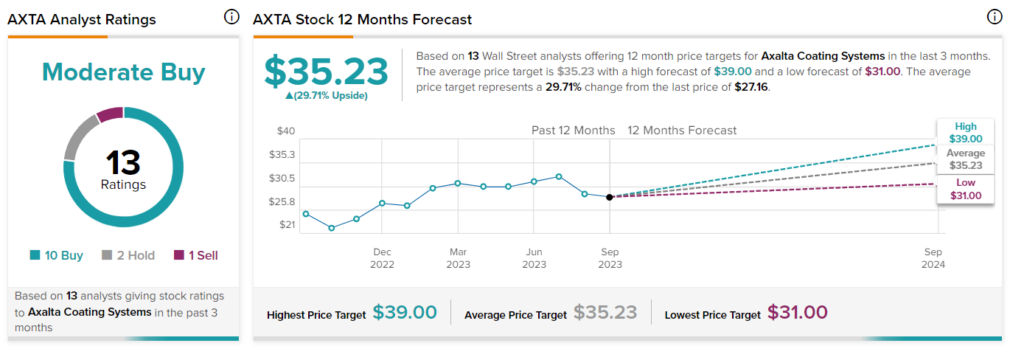

What is the Price Target for AXTA?

Axalta’s growing topline, cost-control initiatives, and focus on finding new opportunities in the market bode well for its long-term growth prospects. However, AXTA’s substantial debt balance keeps analysts cautiously optimistic about the stock.

On TipRanks, AXTA stock has a Moderate Buy consensus rating based on 10 Buys, two Holds, and one Sell. The average stock price target of $35.23 implies 29.7% upside potential. Shares have gained 6% so far in 2023.