Southwest Gas (NYSE:SWX) stock gained about 2% in yesterday’s extended trade after activist investor Carl Icahn continued to bet big on the stock. Importantly, Icahn, founder of Icahn Enterprises (IEP), owns more than 10% of the company’s shares. While Icahn is bullish on SWX stock, the three analysts covering the stock remain on the sidelines.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company engages in the energy business and operates through two business segments: Natural Gas Operations and Utility Infrastructure Services.

As per the SEC filing, Icahn bought 44,256 shares of the company at a weighted average price of $61.98 per share in multiple transactions between September 21 and September 25. Excluding this latest purchase, Icahn bought 127,731 shares of SWX stock worth $7.8 million earlier this month. The total value of SWX stock in Icahn’s portfolio currently stands at $687 million.

According TipRanks, Icahn has had a 67% success rate over the past year, with an average 14.7% return per transaction.

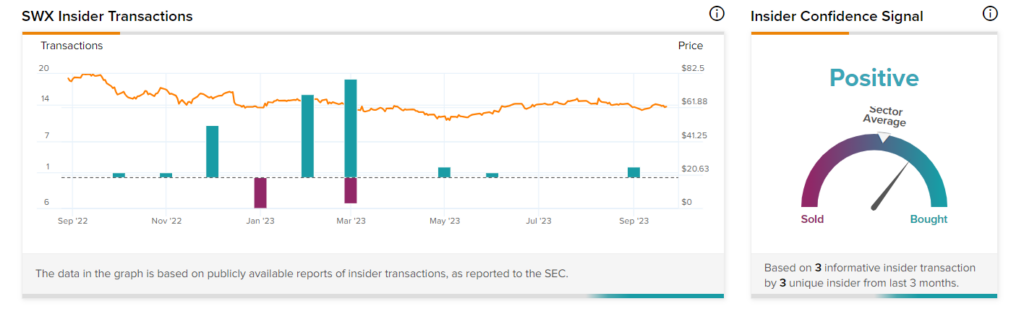

Bullish Insider Confidence Signal

Overall, corporate insiders have bought SWX shares worth $10.6 million over the last three months. TipRanks’ Insider Trading Activity Tool shows that insider confidence in Southwest Gas stock is currently Positive.

Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is SWX a Good Stock to Buy?

While the company’s growth prospects are reflected in population growth and a higher rate base, SWX’s inconsistent dividend growth remains a concern.

Currently, Wall Street is sidelined on Southwest Gas with a Hold consensus rating. This is based on three Holds assigned in the past three months. The average price target of $69.33 implies a possible upside of 11% from current levels. Shares of SWX stock have gained nearly 4% since the start of this year.