Enovix (ENVX), a company that develops and produces silicon-anode lithium-ion batteries, could be perched on the edge of a stock rise. Two recent insider buys, a new facility in Malaysia, and the appointment of new leadership positions all point to the company’s scaling up.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Yesterday, Enovix’s president and CEO, Raj Talluri, bought 5K shares of Enovix for an estimated value of $65,000. That purchase is on top of T.J. (Thurman) Rodgers’ informative buy of $622,681 worth of ENVX stock, 5 days ago. Rodgers is the chairman of the board of directors at Enovix.

Last week, the company announced its plan to build its first high-volume manufacturing facility, located in Malaysia. Then, two days ago, a press release indicated that Enovix had appointed “multiple leadership additions in key functional roles.”

Today, the company will be presenting at the J.P. Morgan Industrials Conference in NYC. It remains to be seen whether Enovix’s CEO will make a stock-moving announcement at the conference.

Is ENVX a Good Stock to Buy?

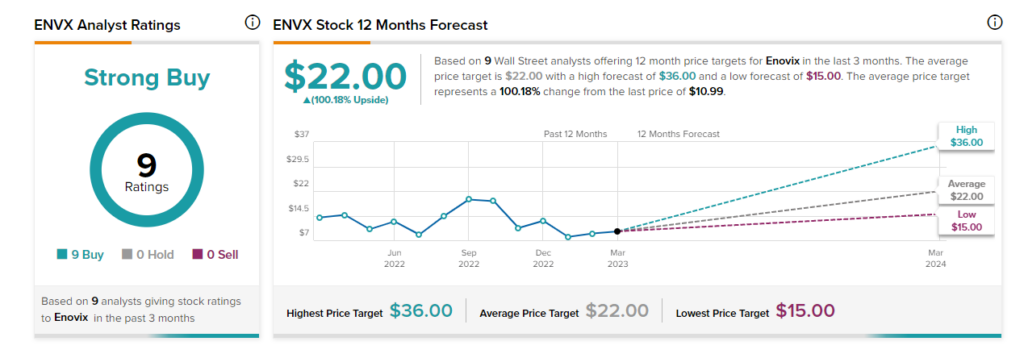

Enovix is a Strong Buy, according the analyst consensus of nine analysts who give it a Buy rating. The 12-month ENVX price forecast of $22.00 implies an upside of more than 100%.

Furthermore, ENVX has a Smart Score of nine, indicating the stock is likely to outperform the market. The stock has risen 11.4% in the past five days.