New York-based Verizon Communications (VZ) provides wireless and wireline telecom services. It serves both consumer and business markets.

For Q4 2021, Verizon reported a 1.8% year-over-year decline in revenue to $34.1 billion but still surpassed the consensus estimate of $33.9 billion. It posted adjusted EPS of $1.31, which rose from $1.21 in the same quarter last year and beat the consensus estimate of $1.29.

Verizon continued with its 5G network deployment, reaching more than 95 million people across the U.S. in 2021 with its 5G Ultra Wideband. It expects its 2022 capital spending related to 5G network rollouts to be in the range of $5 billion to $6 billion.

With this in mind, we used TipRanks to take a look at the risk factors for Verizon.

Risk Factors

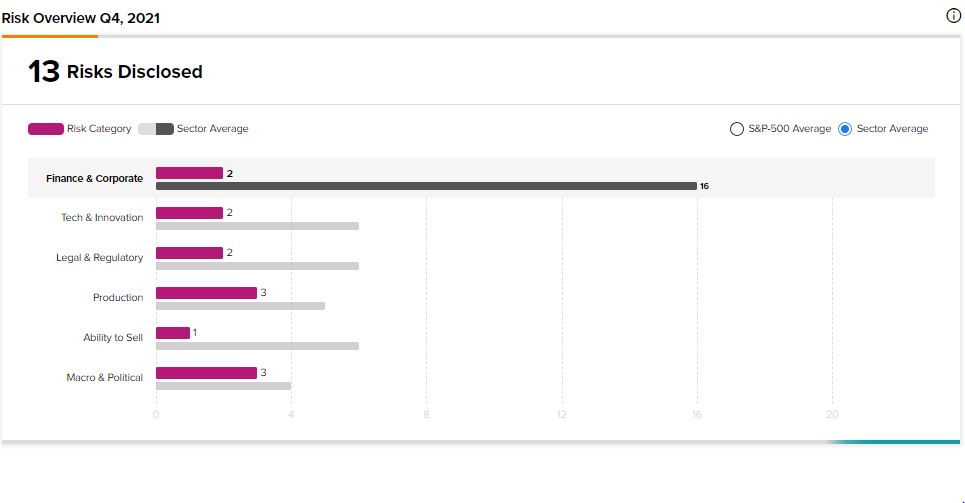

According to the new TipRanks Risk Factors tool, Verizon’s main risk categories are Production and Macro and Political, each containing 3 of the total 13 risks identified for the stock. Finance and Corporate, Tech and Innovation, and Legal and Regulatory are the next three major risk categories, each containing 2 risks. Verizon has recently updated a number of its risk factors across the categories to highlight certain challenges.

The company reminds investors that if its 5G rollout program is delayed, it may see a drop in the demand for its services and experience a decline in profits. It explains that issues related to equipment and spectrum availability, unexpected costs, and regulatory matters could cause delays in its 5G program.

Verizon informs investors that the nature of its business subjects it to potential litigation. It mentions shareholder lawsuits, antitrust class actions, patent disputes, and lawsuits related to its advertising and billing practices. It warns that defending itself against such lawsuits or settling them could cause it to incur significant expenses.

The company tells investors that about 24% of its workforce belonged to unions as of the end of 2021, and more workers could potentially choose to join unions in the future. The company cautions that it could experience work stoppages and incur additional costs as a result of renegotiating labor contracts with its unionized workers.

Verizon’s stock has gained about 3% year-to-date.

Analysts’ Take

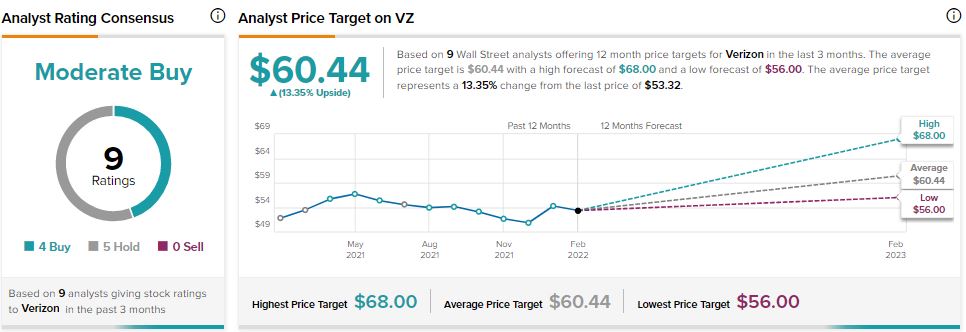

Citigroup analyst Michael Rollins recently reiterated a Buy rating on Verizon stock with a price target of $58, which suggests 8.78% upside potential.

Consensus among analysts is a Moderate Buy based on 4 Buys and 5 Holds. The average Verizon price target of $60.44 implies 13.35% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Aurora Cannabis Q2 Revenue Falls 10%; Loss Shrinks

Chemours Posts Mixed Q4 Results, Shares Plunge 6%

Zillow Posts Q4 Revenues Beat and Upbeat Outlook; Shares Pop 13%