Mastercard (MA) is a global payment solutions company. It serves individuals, businesses, and governments in more than 210 countries.

For Q4 2021, Mastercard reported a 27% year-over-year jump in revenue to $5.2 billion, matching the consensus estimate. It posted adjusted EPS of $2.35, which rose from $1.64 in the same quarter the previous year and beat the consensus estimate of $2.21.

Mastercard plans to distribute a quarterly cash dividend of $0.49 per share on May 9 and has set April 7 as the ex-dividend date.

Mastercard has recently agreed to acquire McDonald’s (MCD) product recommendations platform Dynamic Yield and expects to close the transaction in the first half of 2022. The Dynamic Yield deal follows Mastercard’s acquisition of Latin American bill payments solutions provider Arcus and European open banking provider Aiia.

With this in mind, we used TipRanks to take a look at the risk factors for Mastercard.

Risk Factors

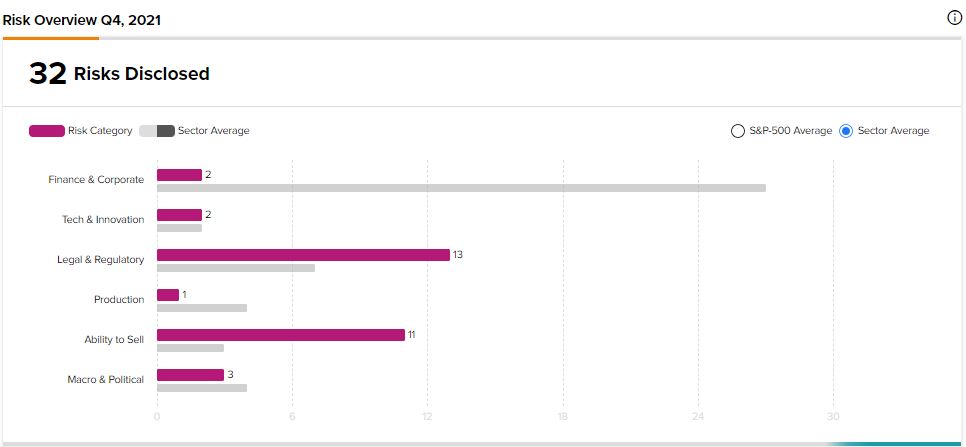

According to the new TipRanks Risk Factors tool, Mastercard’s top risk category is Legal and Regulatory, which contains 13 of the total 32 risks identified for the stock. Ability to Sell and Macro and Political are the next two major risk categories with 11 and 3 risks, respectively. Mastercard has recently updated several of its previously highlighted risk factors to stress certain challenges it faces.

The company informs investors that it continues to evaluate strategic acquisitions to add complementary businesses, products, and technologies. However, it cautions that increasing regulatory scrutiny related to antitrust issues and competition could prevent it from completing future acquisitions. Mastercard further cautions that it may spend money on acquisitions that, in the end, could fail to meet its expectations. The company also says that if it were to pay for an acquisition with cash, its cash reserves available for other uses would be reduced. If it were to fund an acquisition with stock, existing shareholders’ interest would be diluted.

Mastercard tells investors in another updated risk factor that consolidation among its customers could harm its business. For example, Mastercard could lose business if a customer were acquired by a company with strong ties with a competitor. Moreover, consolidation could result in a smaller number of larger customers with significant bargaining power to seek lower prices.

Analysts’ Take

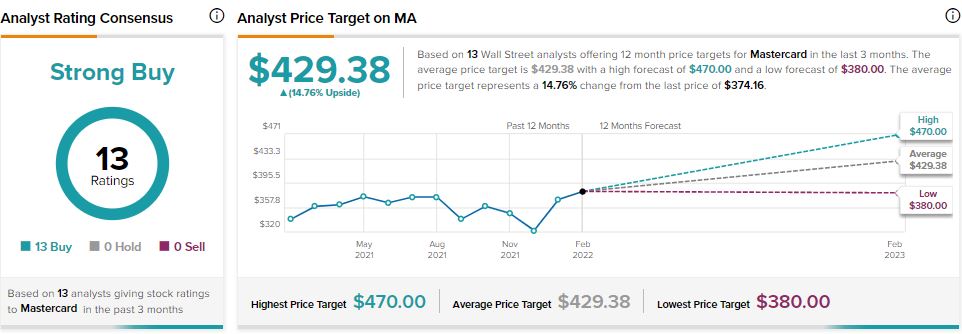

Following Mastercard’s Q4 earnings report, Mizuho analyst Dan Dolev maintained a Buy rating on Mastercard stock and raised the price target to $435 from $400. Dolev’s new price target suggests 16.26% upside potential.

Consensus among analysts is a Strong Buy based on 13 Buys. The average Mastercard price target of $429.38 implies 14.76% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

India Bans Chinese Apps on Security Fears; Sea Tanks over 18%

Paysafe Branches Out into Louisiana and Oregon Mobile Sports-Betting Markets

Juniper Networks Acquires WiteSand for Undisclosed Amount