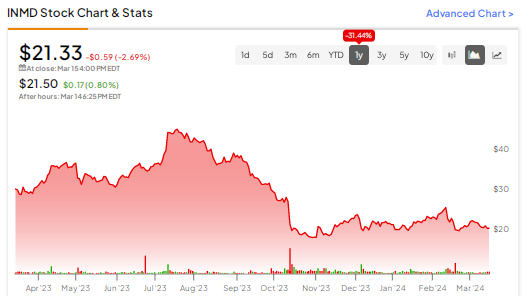

InMode (NASDAQ:INMD) is a leading innovator in the aesthetic medical device industry that has weathered turbulent market conditions in recent years. Macroeconomic pressures and geopolitical disruption have dragged down the stock by over 31% in the past year. However, the company’s robust balance sheet, potential for strategic acquisitions, and discounted share price present a compelling opportunity for investors seeking a long-term value opportunity.

Challenging Environment

InMode uses its proprietary radiofrequency technology to provide innovative, minimally invasive aesthetic medical devices for liposuction, body and face contouring, and ablative skin rejuvenation treatments and offers a range of devices that medical professionals, such as dermatologists, plastic surgeons, gynecologists, and ophthalmologists, utilize in their practices.

While the company has a footprint across international markets, most of its revenue comes from the U.S., which dominates global demand for procedures like liposuction. The rise in interest rates has taken a toll on the aesthetic industry over the past few years, as the increase in costs diminished the demand for these optional procedures.

Furthermore, while InMode started FY2023 with robust guidance, it was lowered multiple times, partially due to disruption associated with the location of InMode’s headquarters in Israel in the aftermath of the attack on October 7th.

Recent Results and Future Outlook

Despite the challenges in the second half of 2023, InMode still surpassed market expectations. The company reported an EPS of $0.71 for Q4 2023, beating forecasts of $0.66. However, the company posted a 5% year-over-year decline in Q4 revenue, totaling $126.8 million. Despite this, InMode’s gross margin remained solid and steady at an industry-leading 84%.

The full-year 2023 results revealed revenues of $492 million, an 8.3% increase from the prior year. This was accompanied by a net income of $197.9 million, surging 23% from the previous year, and a profit margin of 40%, up from 36% in 2022.

Concerning future projections, InMode expects 2024 revenues between $495 million and $505 million, non-GAAP gross margins between 83% and 85%, non-GAAP income from operations between $217 million and $222 million, and non-GAAP EPS between $2.53 and $2.57.

Where the Stock Stands Now

Over the past year, INMD stock has fallen over 30% into the $21 range. INMD is trading towards the bottom of its 52-week range of $18.57-$48.25. It shows negative price momentum, trading below the 20-day ($22.25) and 50-day ($22.76) moving averages.

The falling share price has pushed the stock into value territory. Its price-to-earnings ratio of 9.2x is a significant discount to the Healthcare sector average of 27.64x, while the EV/EBITDA of 5.64x is well below the company’s historical average of 17.9x.

The company boasts a strong balance sheet, with a sizable cash position and no debt. CEO Moshe Mizrahy has previously indicated that any target acquisition would be accretive and not dilutive to shareholders. If they find such a target in 2024, it could likely catapult the share price, as would a decision to use some of the cash stockpiled to buy back shares.

What is the Price Target for INMD in 2024?

Analysts covering INMD stock have been cautiously optimistic, citing the company’s technological edge, strong balance sheet, and healthy gross margins. Recent buyers of note include Cathie Wood’s ARK Investment Management, which now holds a stake worth over $2 billion in the company.

INMD is currently listed as a Moderate Buy based on six analysts’ stock ratings in the past three months. The average 12-month price target of $30.25 represents an upside potential of 41.82% from current levels.

Closing Thoughts

InMode has faced a series of challenges in recent years, including a rise in interest rates and operational disruptions, which have depressed the stock. However, the company’s unique proprietary technology, robust balance sheet, and potential for opportunistic acquisitions position it favorably moving forward. Its current discount looks to be an appealing entry point for long-term value investors.