Informatica (NYSE:INFA) plunged in trading on Monday following news that discussions between the company and cloud-based software company Salesforce (NYSE:CRM had fizzled out, according to a report by The Wall Street Journal. However, the cloud data management company stated that it was not currently engaged in any such acquisition discussions.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Informatica Updates FY24 Outlook

Meanwhile, the company updated its FY24 outlook and now expects that it will meet the upper half of its guidance range for its previously provided forecast for revenues, subscription annual recurring revenues (ARR), and adjusted operating income. Subscription ARR indicates the predictable income from annual subscription contracts.

Informatica had previously forecasted FY24 revenues between $1.68 billion and $1.71 billion, with total subscription ARR expected to range from $1.26 billion to $1.29 billion. The company projected adjusted operating income to be between $533 million and $553 million, indicating a year-over-year growth of 17.5%.

Furthermore, Informatica expects to release its Q1 results on May 1. In addition to this, the company announced the exit of Jitesh Ghai, the EVP, and Chief Product Officer from the company.

Is INFA Stock a Good Buy?

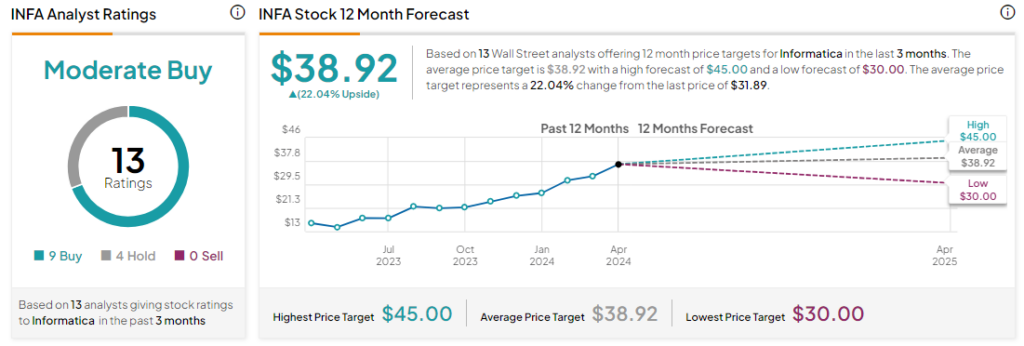

Analysts remain cautiously optimistic about INFA stock, with a Moderate Buy consensus rating based on nine Buys and four Holds. Year-to-date, INFA has increased by more than 10%, and the average INFA price target of $38.92 implies an upside potential of 22% from current levels.