For Canadian oil stock Imperial Oil (TSE:IMO) (NYSE:IMO), its earnings report should have proven welcome news for shareholders. However, it didn’t quite turn out as well as hoped, though, as shares were down fractionally in Friday morning’s trading session despite some decent results.

Imperial Oil saw its profit rise, as reflected in its first-quarter earnings report, thanks in large part to solid production numbers. Imperial Oil pushed an average of 407,000 barrels per day (BPD) through its operations, which was down slightly from last year’s figure of 417,000. It was also down against the slight decline that analysts were expecting, at 415,000.

However, that comparatively slight discrepancy—less than 5% of the figures in question—had a reasonable explanation to go along with it; maintenance activities were hampering some of the throughput processes. Oddly, though, refinery utilization rates were also down somewhat, from 96% in 2023’s first quarter to just 94% in 2024’s first.

Maintenance Trouble to Continue

The maintenance issues won’t stop there, either; reports note that Imperial Oil will see further reductions over the course of this year from further maintenance slowdowns. The Kearl Sands project will have a shutdown of “undisclosed” duration that will take 6,000 BPD off the table in the second quarter, and the third quarter will feature the likewise “undisclosed” duration loss of Cold Lake, costing 3,000 BPD.

However, with Imperial Oil keeping its dividend payments up, this may not be anything more than a slight hiccup. Indeed, based on the numbers seen in the first quarter, losing a few thousand barrels per day might even be considered trivial.

Is Imperial Oil a Good Buy?

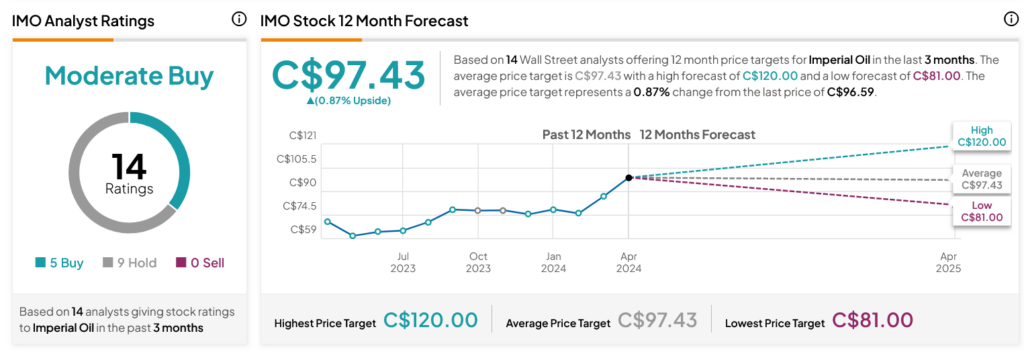

Turning to Wall Street, analysts have a Moderate Buy consensus rating on IMO stock based on five Buys and nine Holds assigned in the past three months, as indicated by the graphic below. After a 42.81% rally in its share price over the past year, the average IMO price target of C$97.43 per share implies 0.87% upside potential.

Is IMO the Right Stock to Buy for Passive Income?

Before you hurry to invest in IMO, think about the following:

TipRanks’ team has built a Smart Dividend Stock Portfolio for investors, and Imperial Oil is not included. Our portfolio highlights companies that have been hand-picked for their potential to deliver significant passive income for years to come.

Get a FREE sample of dividend stock insights! >>