Hindenburg Research has proven a disaster to stocks before, as big a disaster as its namesake implies. Recently, Hindenburg took aim at Icahn Enterprises (NASDAQ:IEP), causing the stock to plunge over the past couple of weeks. Earlier today, Hindenburg updated its short report on IEP stock, causing it to slip an additional 1.83% in today’s session.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Hindenburg, who turned Nikola (NASDAQ:NKLA) into a smoking crater with its report “How to Parlay an Ocean of Lies into a Partnership With the Largest Auto OEM in America,” said that it was shorting Icahn bonds, noting that they were “inflated.” Further, Hindenburg asserted that IEP was trading above its net asset value and suggested that it was engaged in a “Ponzi-like” structure in order to pay its dividends, Reuters noted. It didn’t help Icahn much that the feds launched a probe into Icahn Enterprises one day following Hindenburg’s report.

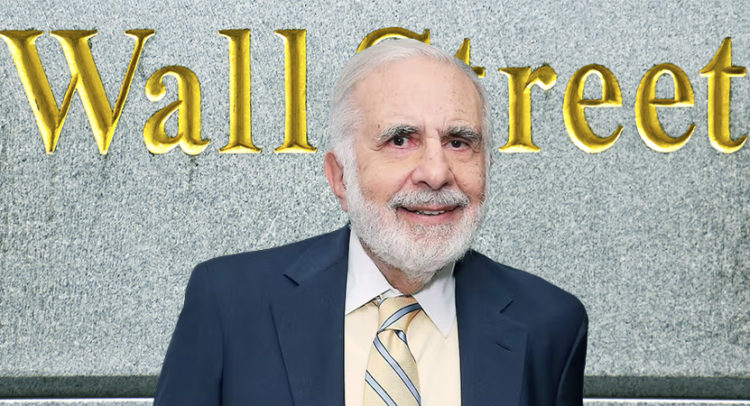

Icahn—via its director Carl Icahn—responded with spectacular venom, declaring that Hindenburg should be renamed “Blitzkrieg Research.” Furthermore, he claimed that Nate Anderson—Hindenburg’s founder—routinely performed “…disinformation campaigns to distort companies’ images, damage their reputations and bleed the hard-earned savings of individual investors.” Icahn called the Hindenburg report “self-serving” and declared that he would “fight back.”

A look at the last three trading months for IEP stock shows just what kind of impact the report had. Before the report hit, IEP was largely plateaued around the $52 mark, with little movement in either direction. That is until the report hit, and IEP suddenly slid to under $30. A rally followed but didn’t last long as Icahn doubled back to around $31 once again.