Shares of Icahn Enterprises (NASDAQ: IEP) are down almost 20% at the time of writing following yesterday’s approximate 20% decline. This can be attributed to yesterday’s report from short-seller Hindenburg Research, which alleges that the firm’s net asset values are inflated.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

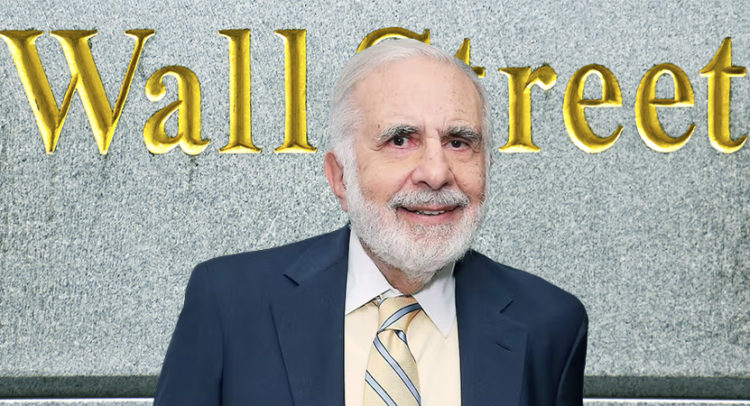

Billionaire Carl Icahn, who owns 88% of the company, responded today to the short-seller’s claims, calling them “self-serving” and “intended solely to generate profits on Hindenburg’s short position at the expense of IEP’s long-term unitholders.” Icahn pointed to his track record over the past 25 years as evidence for the effectiveness of his approach to activist investing and stated that the short-seller won’t deter IEP from fulfilling its commitments to unitholders.

Nevertheless, a look at the past several trading days shows the damage that Hindenburg’s report has done to IEP stock. Indeed, investors are down over 36% during this timeframe.