The International Energy Agency (IEA) expects the global oil demand to rise to an all-time high in 2023, fueled by the easing of COVID-19 restrictions in China. IEA estimates oil demand to grow by 1.9 million barrels per day (b/d) to reach 101.7 million b/d this year.

“Two wild cards dominate the 2023 oil market outlook: Russia and China,” said the Paris-based energy organization in its monthly report. It expects China to drive nearly 50% of the global demand growth despite the uncertainty associated with the “shape and speed” of the reopening.

Meanwhile, IEA anticipates oil balances to tighten as Russian supply slows due to the full impact of western sanctions. Russian oil exports declined 200,000 b/d month-over-month to 7.8 million b/d in December 2022 due to the European Union embargo on Russian crude and the G7 price cap.

In Q4 2022, oil supply exceeded demand by over 1 million b/d despite OPEC+ production cuts and winter storms-led disruptions to the U.S. supply. Meanwhile, oil demand in Europe fell due to weak industrial activity and mild weather. Q4 2022 oil demand was also impacted by China’s COVID-19 restrictions and winter blizzards that affected holiday travel in North America. Overall, demand declined by 910,000 b/d year-over-year in the OECD nations and by 130,000 b/d in China in Q4 2022.

Looking ahead, oil demand is expected to be strong due to China’s reopening despite recessionary fears in Europe and the U.S. If demand is solid this year, as forecasted by the IEA, then it would benefit oil giants. Let’s have a look at two oil stocks that could gain from a favorable demand backdrop this year.

Exxon (NYSE:XOM)

Exxon generated phenomenal profits last year, thanks to the surge in oil and gas prices due to robust demand following the reopening of the economy and the severe supply disruption caused by the Russia-Ukraine war. Adjusted EPS surged 220% to $10.66 in the first nine months of 2022.

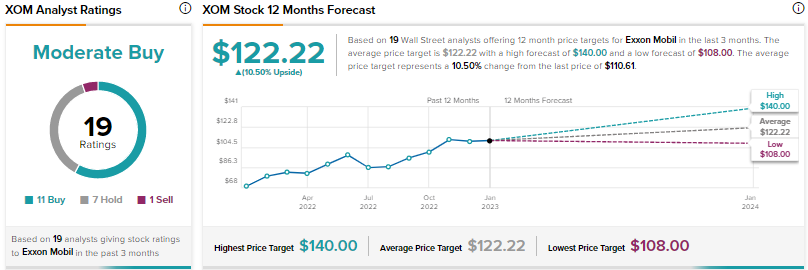

On TipRanks, Exxon scores a Moderate Buy consensus rating based on 11 Buys, seven Holds, and one Sell. At $122.22, the average Exxon price target indicates upside of 10.5% from current levels. Shares have jumped more than 51% over the past year.

Chevron (NYSE:CVX)

CVX shares have rallied 37% over the past 52 weeks. Chevron’s adjusted EPS increased 165% to $14.74 in the first nine months of 2022 due to robust global energy demand and increased production from its U.S. oilfields.

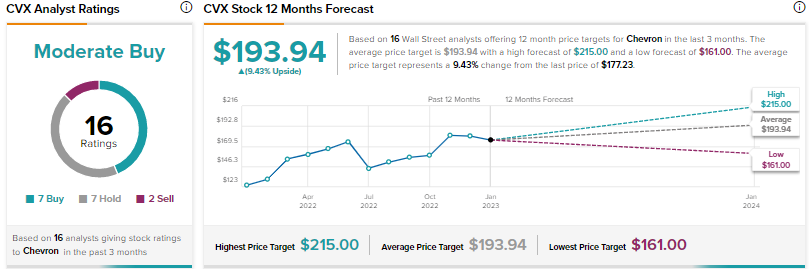

Wall Street’s Moderate Buy consensus rating for Chevron is based on seven Buys, seven Holds, and two Sells. The average CVX price target of $193.94 suggests 9.4% upside potential.