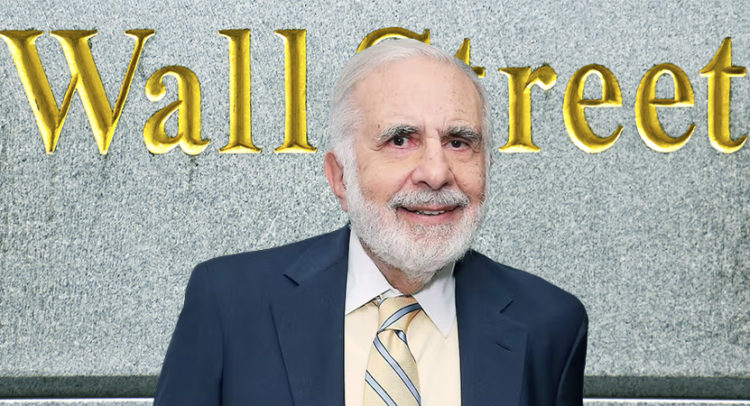

The recent release of a report from Hindenburg Research sent Icahn Enterprises (NASDAQ:IEP) on the skids. In Tuesday’s trading, however, Icahn Enterprises pulled up out of its skid and closed 8.01% higher. Perhaps the biggest reason for this turnaround was the revelation that Hindenburg’s report didn’t exactly find anything that wasn’t already somewhat well known.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The Semafor report that detailed the matter noted that Icahn Enterprises had already been planning reorganization efforts, from new fundraising options to asset swaps, for some time ahead of the Hindenburg Research report. A combination of shareholder concern and a probe from the Department of Justice ultimately put those efforts on the back burner for now.

Responses to the Icahn plan varied extensively. While shareholders looked askance and the Justice Department wasn’t happy, some noted that the move wasn’t so bad after all. Pinxter Analytics recently noted that the yield was worth at least some risk, and that made Icahn actually worth a closer look. Pinxter went so far as to thank Hindenburg for “the early retirement.” However, a report from TheStreet suggested that Icahn’s empire may be falling apart in a case of living by the sword and dying by it.

A look at the last five days in trading for Icahn Enterprises shows how volatile the stock actually is, though it’s volatile in an overall positive direction. There have been several spikes in share price, though these have been comparatively small; one spike took shares from $19.44 to $21.64 before ultimately slipping back to $19.35 and starting upward again. However, shares are up substantially since their five-day low back on May 25.