Tech giant IBM (IBM) has launched a new AI model called FlowState, which is designed to make accurate predictions using time-series data. For reference, this type of data is used to forecast information that is collected over specific timeframes, such as traffic patterns, stock prices, or quarterly sales. FlowState stands out because it uses a special kind of architecture called a state-space model (SSM), which allows it to perform just as well, or even better, than much larger models on complex forecasting tasks. Instead of just looking at one fixed timescale, FlowState can adjust dynamically to different time ranges.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As a result, this helped it land in second place on Salesforce’s (CRM) GIFT-Eval leaderboard for zero-shot time-series forecasting. What sets FlowState apart is its ability to understand patterns across multiple timescales without needing huge amounts of data. Indeed, most transformer-based models are trained on lots of examples and require massive computing power. However, FlowState takes a more efficient approach by using an encoder to turn time-series data into a general, scale-free format and a decoder to translate that into a specific forecast.

This means that it can generate predictions at any time interval, even ones it hasn’t seen during training. In addition, despite being small at just 9.1 million parameters, it competes with models that are more than 20 times its size and does so at a much lower cost. Interestingly, it is worth noting that FlowState currently works best for simple forecasting problems that involve one variable, like predicting web traffic or customer purchases. Nevertheless, IBM researchers are already working to expand it to handle more complex and multi-variable problems.

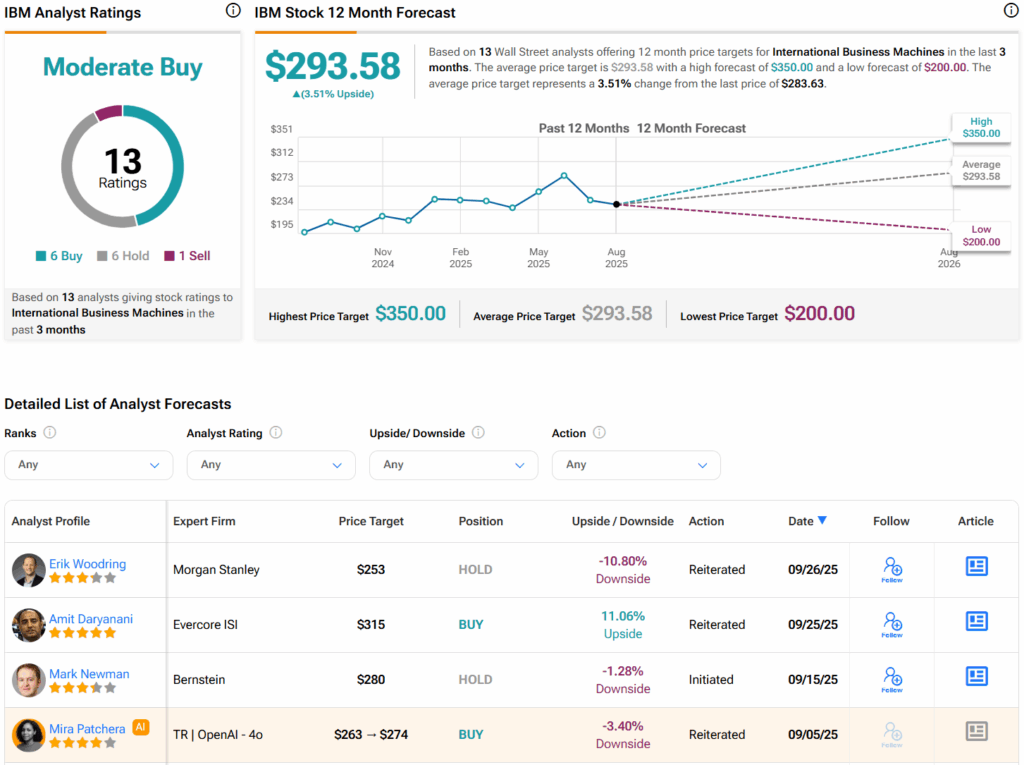

Is IBM a Buy, Sell, or Hold?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on IBM stock based on six Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average IBM price target of $293.58 per share implies 3.5% upside potential.