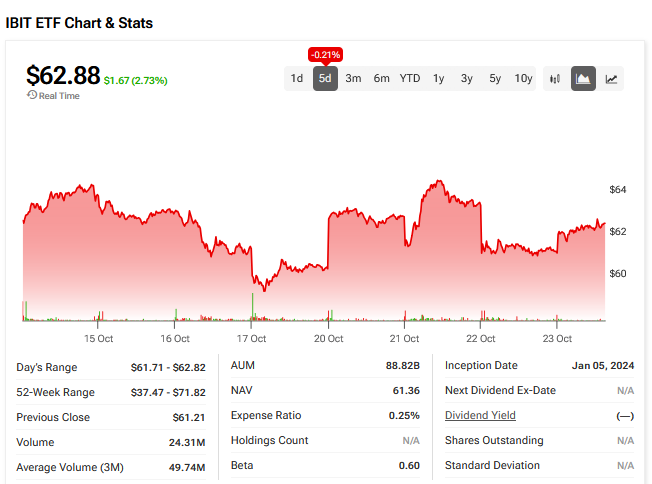

How is IBIT stock faring? The iShares Bitcoin Trust (IBIT) was back in business today. It is now down only 0.21% over the past 5 days, and 15.38% higher in the year-to-date.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

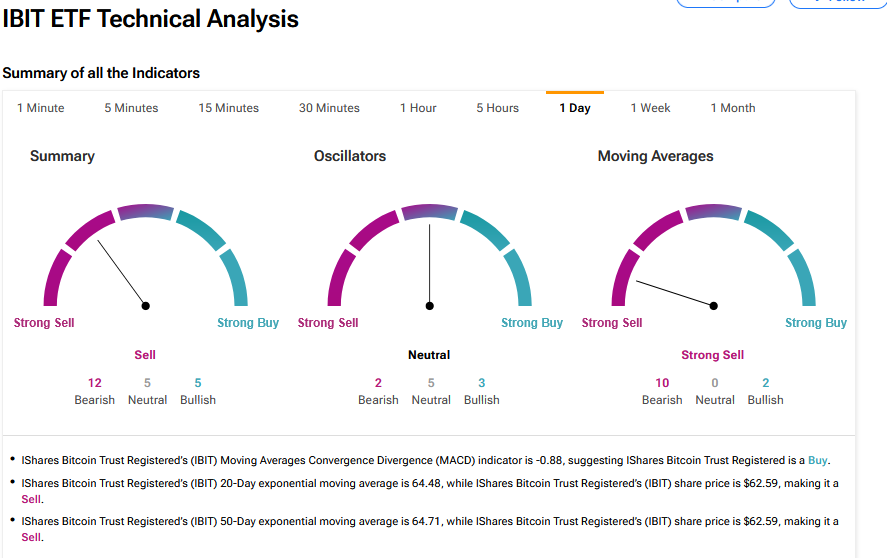

According to TipRanks technical analysis, the IBIT is now at a Strong Sell consensus based on 12 Bearish, 5 Neutral and 5 Bullish ratings.

Based on the activity of 824,625 investors in the recent quarter, it has scored above-sector-average very positive sentiment. Those investors aged between 35 and 55 have been the most active buyers.

In total 1.9% of all portfolios hold IBIT.

Today’s IBIT Performance

Today, the IBIT climbed 2.96% in mid-trading to $62.98. The main driver was the price of bitcoin, which increased 3.06% to $110,886.47.

Analysts said traders were positioning themselves ahead of tomorrow’s key U.S. inflation report. “The only print that matters this week is Friday’s CPI, the sole release the Fed will see before policy rhetoric resumes,” analysts at QCP Capital said.

According to QCP, a softer CPI reading could re-anchor the “soft-landing” economic narrative and fuel renewed upside for bitcoin.

John Glover, chief investment officer at Ledn, however, was less positive. He told Yahoo Finance UK that he believes the latest bull cycle has ended.

“I firmly believe that we have finished the five wave move higher, and we will now commence a bear market that will last into late 2026 at a minimum,” he said.

Power up your ETF investing with TipRanks. Discover the Top Equity ETFs with High Upside Potential, carefully curated based on TipRanks’ analysis.