Tesla (NASDAQ:TSLA) stock has been riding high lately, buoyed by the recent turn of events that have pushed it 47% higher since the company’s Q1 2025 earnings call late last month.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What really lit the fuse was Elon Musk’s announcement that he’d be stepping back from most of his D.C. commitments, a move that reassured investors after a shaky start to the year. You see, betting on Tesla has always meant betting on Musk – his vision, his leadership, and his knack for turning ambitious ideas into real profits. So naturally, the market welcomed the news that he’d be refocusing his energy on Tesla’s day-to-day operations.

However, long-term hopes can sometimes run into the brick wall of near-term constraints – and that’s exactly what one investor, known by the pseudonym Oakoff Investments, expects to happen. Specifically, the investor doubts Tesla’s ability to break free from its worsening fundamentals.

“Despite recent stock strength, Tesla’s Q1 earnings missed expectations, with declining revenues, margins, and brand power raising red flags,” notes Oakoff.

According to the investor, Tesla is already facing fallout from Musk’s political entanglements, which may have contributed to a drop in EV sales earlier this year. Although bullish investors continue to pin their hopes on transformative technologies like full self-driving, robotaxis, and the Optimus humanoid robot, Oakoff warns that these breakthroughs are still far from ready for primetime.

“Long-term bets on robotaxis and humanoids are risky and won’t offset near-term auto and energy business headwinds or margin compression,” Oakoff adds.

Oakoff argues that Tesla should be valued more like a hybrid: part high-growth stock (energy business plus robotaxis and humanoids), part traditional automaker. And even under that framework, the numbers don’t look great. With Tesla currently trading at an EV/EBITDA of 86x on a trailing basis, Oakoff believes the stock is priced far above what the fundamentals support.

To make matters worse, the investor doesn’t see Tesla clawing its way back to the 20–25% margin range anytime soon. Competition is heating up, and the market dynamics have shifted. In other words, growing near-term pressures will likely lead to losses up ahead.

“I remain skeptical of Tesla’s prospects in the near future as I fear the sustainability of its gross margins. I don’t see a way out of the current situation,” concludes Oakoff, who rates TSLA shares a Sell. (To watch Oakoff Investment’s track record, click here)

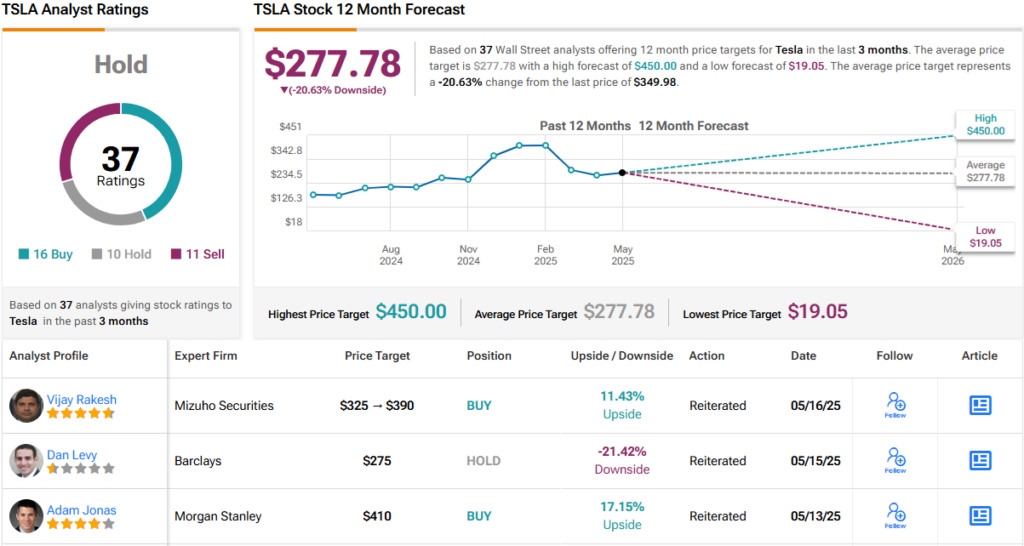

Meanwhile, Wall Street remains divided. With 16 Buy, 10 Hold, and 11 Sell recommendations, TSLA holds a consensus Hold (i.e., Neutral) rating. Its 12-month average price target of $277.78 implies a potential downside of ~21%. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.