Supply and demand might be one of the oldest laws in economics, and for Canadian mining stock Lithium Americas (TSE:LAC) (NYSE:LAC), it’s just as inviolable as ever. Just ask shareholders, who fled the stock like a flooding mineshaft in Thursday morning’s trading after news emerged that Lithium Americas was planning a big stock sale. That was sufficient to send shares down over 27% in the session.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Worse yet, as far as investors were concerned, Lithium Americas wasn’t planning a modest stock sale, either. Something simple to get them over the hump. No, they’re planning to sell a whopping 55 million shares in a public offering and throwing in an option for underwriters to grab another 15% on top of that, a little over eight million shares besides.

That, all told, might mean around 64 million new shares. Given Lithium Americas’ current share price of C$6.66, that’s just over C$385 million coming in. Lithium Americas plans to put that cash to use to develop its Thacker Pass lithium project in Nevada.

Shares Being Sold at a Discount

One major reason that shareholders sold off now is likely thanks to word that the new shares of stock will be sold at a discount over their current equivalents. Reports note that the new private offering will be valued at $275 million, which is a substantial discount. Therefore, why hold shares that are priced significantly higher in the face of a new pile of shares that will cost much less? Sell the higher-priced shares now and buy the cheaper versions later.

And that’s not a bad idea, either; the lithium market was valued at $22.19 billion in 2023, but by 2032, it’s likely to reach $134.02 billion. Building out a lithium mine in these conditions sure looks like a good idea.

Is Lithium Americas Stock a Buy?

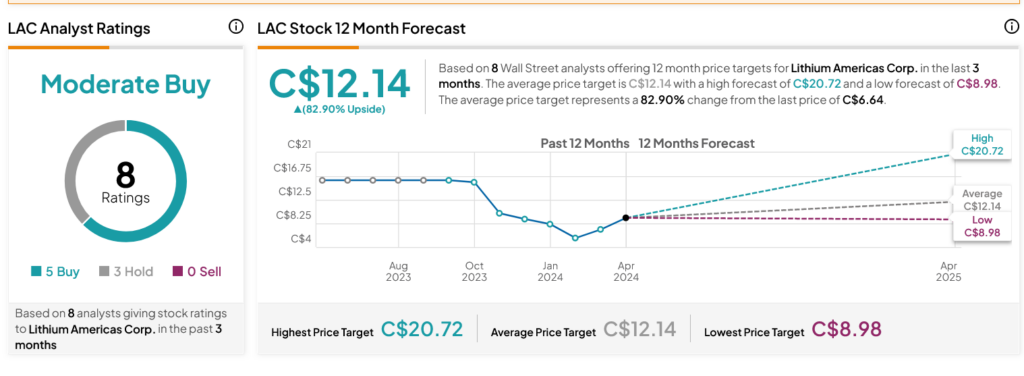

Turning to Wall Street, analysts have a Moderate Buy consensus rating on LAC stock based on five Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 58.4% loss in its share price over the past year, the average LAC price target of C$12.14 per share implies 82.9% upside potential.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue