Cruise line operator Carnival Corporation (CCL) was recently upgraded to a “Hold” rating by HSBC after reporting strong results for the first quarter and showing positive trends in bookings and pricing. This upgrade also came with a 71% increase in its price target to $24 per share and is helping the stock stay on track for its sixth consecutive week of gains. Interestingly, HSBC analysts noted that Carnival is benefiting from strong demand for cruises and an expanding customer base, even as people cut back on other non-essential spending.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Although there are still some risks in the travel sector, particularly with changing consumer spending, HSBC analysts highlighted that Carnival has a competitive advantage over land-based operators. They pointed out that more consumers are choosing to spend on travel, and Carnival has shown flexibility in adjusting its services and costs to adapt to market changes. As a result, the company’s ability to adjust its operations makes it more resilient in case of an economic downturn compared to other companies in the industry.

HSBC also addressed the worries about Carnival’s finances, such as its balance sheet and slower profit recovery. It noted that the company has improved its EBITDA margins by 500 basis points since last year, and its debt levels are expected to decrease significantly in the coming years. This led HSBC to raise its 2025 and 2026 EBITDA estimates by 6.9% and 10.5%, respectively, while EPS targets were raised by 22.7% and 33.7%.

Is CCL a Good Stock to Buy Now?

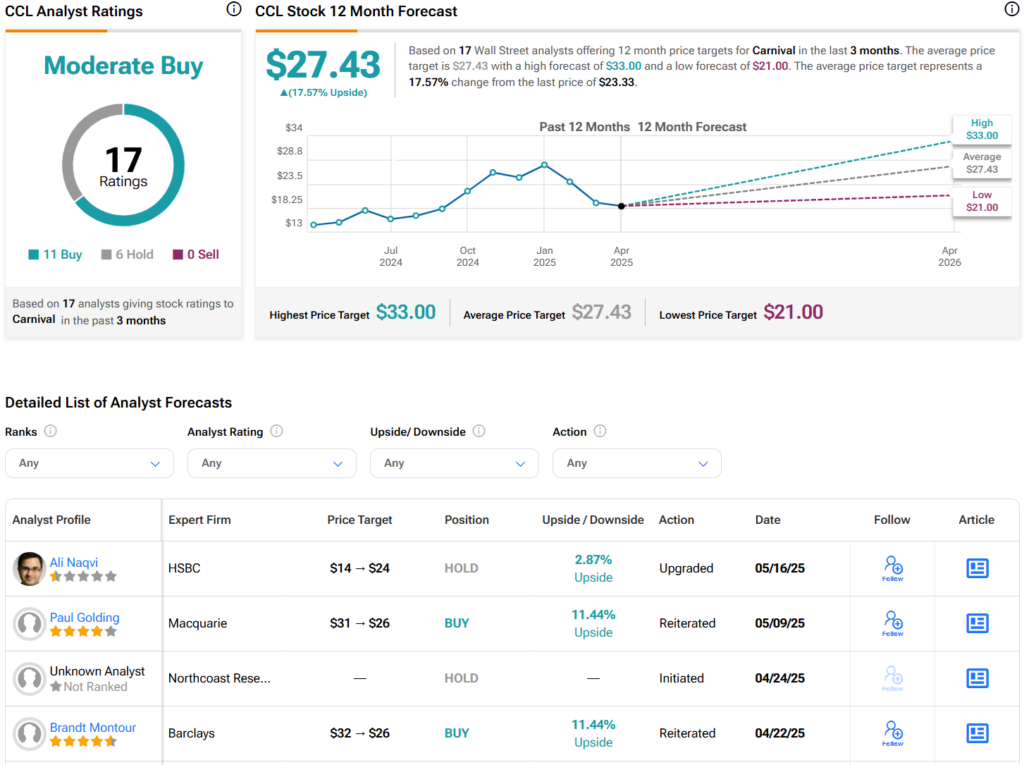

Turning to Wall Street, analysts have a Moderate Buy consensus rating on CCL stock based on 11 Buys, six Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average CCL price target of $27.43 per share implies 17.6% upside potential.