There are new proposed rules from the government that could affect the hydrogen industry. The U.S. Treasury unveiled a rigorous framework for hydrogen producers last week, outlining guidelines to qualify for PTCs (production tax credits) under section 45V.

In the Notice of Proposed Rulemaking (NPRM), the US Treasury laid down three must-haves in Electricity Attribute Certificates (EACs) that hydrogen producers need to meet to claim the tax credit: 1) Additionality: The electricity powering hydrogen must originate from a new (incremental) clean source. 2) Deliverability: The clean electricity sourced must be from the same region as the hydrogen producer. 3) Time-Matching: The electricity generated should be utilized in the same hour as it is produced (by 2028).

However, as there is a 60-day comment period, the rules and processes might undergo some changes so nothing is set in stone quite yet.

One company that could be affected by the above is Plug Power (PLUG). While the hydrogen specialist believes that the policy document has nuances, suggesting a possible pathway for its plants to qualify for credits, Northland analyst Abhishek Sinha thinks that some of its plants could come “under direct scrutiny.”

“Georgia plant could be entangled in additionality factor but PLUG believes RECs (renewable energy credits/certificates) should qualify for PTC,” the analyst explained. “Although Texas plant gets power supply from wind farm, the issue for PLUG would be to meet the hourly matching requirements after 2028. NY plant gets hydro power but there is ambiguity around that too in terms of eligibility. All in all, hourly matching is the most concerning factor for PLUG.”

Regardless of the 45V framework’s implications, Plug Power seems determined to complete its projects. According to the company, by the end of this month, the Georgia plant should be able to produce liquid hydrogen, and by the end of January, the Tennessee plant should be back online.

As for Sinha, until there’s more clarity on the pathways to eligibility, and on the real impact on the company’s hydrogen projects, he remains on the sidelines, recommending a Market Perform (i.e., Neutral) rating. Sinha, though, might as well have said Buy, as his $7 price target suggests the shares will climb 46% higher in the months ahead. (To watch Sinha’s track record, click here)

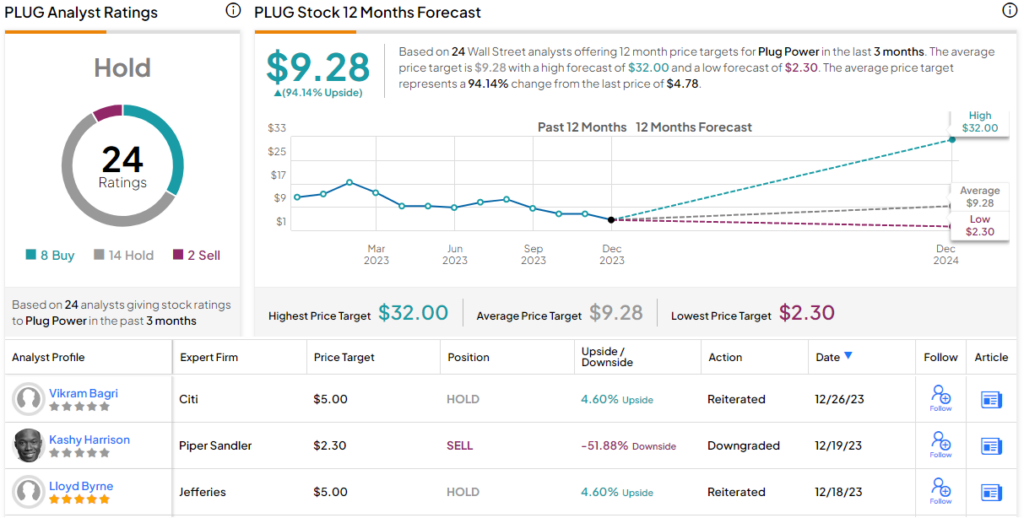

The Street’s overall take also appears to be somewhat confusing. Based on a mix of 14 Holds, 8 Buys and 2 Sells, the stock claims a Hold consensus rating. However, given several very upbeat analysts, the $9.28 average target implies shares will post growth of a handsome 94% over the one-year timeframe. (See Plug Power stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.