In baseball, a runner on second base poses a unique challenge: they can often see the catcher’s signs and relay them to the batter, giving the hitter a valuable edge. For the player at the plate, that extra information can be the difference between striking out and connecting solidly. Traders may find themselves in a similar spot with UiPath (PATH)—where having access to the right signals could meaningfully tilt the odds in their favor.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

One of the more exciting names in the broader artificial intelligence (AI) ecosystem, UiPath specializes in robotic process automation (RPA). Essentially, the company builds “software robots” that automate repetitive digital tasks across various applications. Therefore, instead of humans clicking through multiple screens, UiPath bots conduct this process quickly, consistently, and at scale.

Sounds great, right? As with any innovative enterprise, many challenges exist. One likely concern is that investors would prefer to see the company generate more robust free cash flow. Yes, FCF on a trailing 12-month (TTM) basis stands at nearly $310 million. However, UiPath also needs to compete with sector giants. Stronger flows enable reinvesting in research and development, as well as more aggressive marketing, among other benefits.

So far, PATH stock has exhibited a patchy performance, reflecting both optimism and concerns about business viability. As such, it’s not terribly surprising that the equity is down about 4% while other AI investments have soared.

That’s where the baseball analogy comes in: in the options market, professional traders are quietly signaling optimism through their cumulative positioning. In other words, UiPath is a stock you’ll want to keep firmly on your radar.

Options Premium Data Gives the Game Away

Even if you’re not an options trader, understanding the basic trajectory within the derivatives market can only be helpful. Since transactions in this arena don’t attract as many eyeballs as they would in the open market, professional and institutional traders can make significant moves without setting off alarm bells. Part of this stems from the structure of options, as each contract commands the leverage of 100 shares.

The other wrinkle about options data is that very few financial publication outlets bother to record “cumulative” trends. Typically, these outlets run splashy headlines because of unusual activity for that particular day. Unfortunately, such mechanisms are relatively useless because daily options data can be incredibly noisy. However, when tracked over time, a discernible pattern may emerge.

According to data provided by Fintel, net long premiums bought in the options market jumped from $279,891 at the beginning of September to a cumulative total of $1.15 million by the close of the Sept. 25 session. During the same period, PATH stock steadily marched higher, from $10.90 per share to $12.21.

Empirically, the correlation coefficient between the two metrics was 89.96%. As net long premiums increased, so too did PATH stock. Plus, there’s intriguing evidence that the purchase of long options is a key leading catalyst for UiPath.

Specifically, on September 19, cumulative net long premiums totaled $323,259. In the next session, this metric jumped to $1.64 million. During the same period, PATH stock rose from $11.87 to $13.14 — an 11% increase.

Fundamentally, tracking net long premiums may be more effective than deciphering other forms of options-related data because of the underlying transactional structure. Buying a long premium essentially means buying call options. Such debit-based transactions require the target security to hit defined profitability thresholds; otherwise, the position will not be profitable.

As such, when net long exposure steadily rides on the debit side, by mechanical deduction, the underlying security must rise for profitability to be achieved.

Leveraging Quantitative Data to Extract an Options Trade

Last week, PATH stock exhibited choppy behavior, resulting in a positive return of 0.25% over the trailing five sessions. That means in the previous 10 weeks, PATH printed an evenly balanced sequence of five up weeks, five down weeks, with an overall negative trajectory. For classification, we can label this behavioral state as 5-5-D.

Although it doesn’t seem like it due to the balanced profile, it’s a relatively rare occurrence. Since January 2022, this sequence has only materialized 15 times. What’s interesting, though, is that over the next 10 weeks, the conditional probability that PATH stock will rise higher relative to the starting point is conspicuously greater than the baseline probability of all outcomes in the dataset.

What’s even more intriguing is that the median price of outcomes tied to the 5-5-D sequence is also, on average, greater than the median price of all outcomes. Using this market intelligence, the options strategy that arguably makes the most sense is the 12/13 bull call spread expiring November 21st.

The above transaction involves buying the $12 call and simultaneously selling the $13 call, for a net debit paid of $45 (the maximum possible loss). Should PATH stock rise through the second-leg strike price of $13 at expiration, the maximum profit is $55, a payout of over 122%.

At the time of writing, the breakeven price is $12.45. That’s less than 2% higher than Friday’s close, which is a realistic target given UiPath’s kinetic energy. On the other end, the $13 price target is admittedly ambitious. However, it’s not entirely unreasonable, especially since the median price associated with the 5-5-D sequence’s forward pathways peaks at around $12.70.

What is the PATH Stock Price Forecast for 2025?

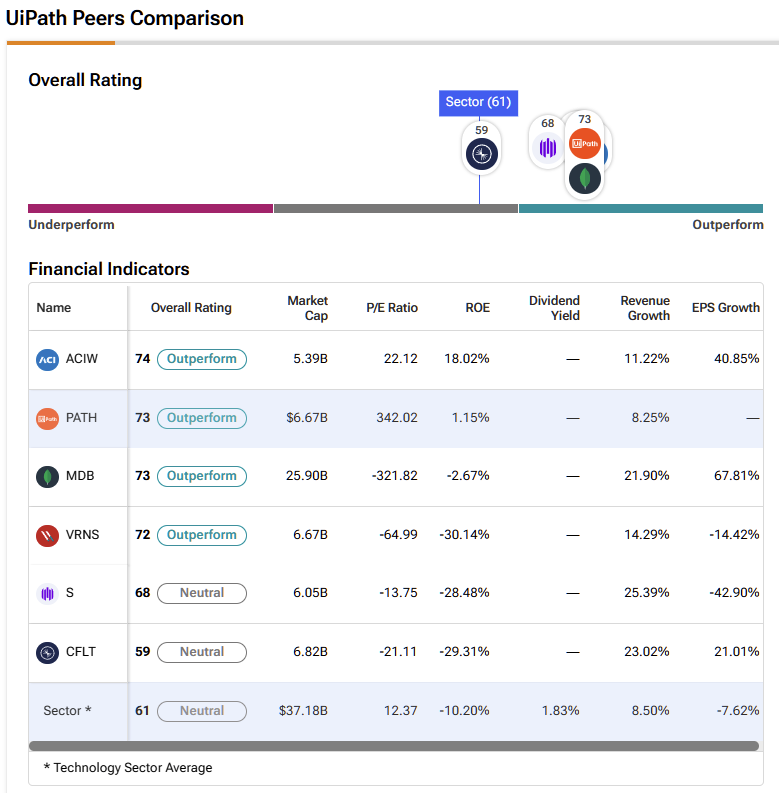

Turning to Wall Street, UiPath has gathered a Hold consensus rating based on two Buys, 15 Holds, and one Sell rating over the past three months. The average PATH stock price target is $13.36, implying 6.4% upside potential over the coming year.

Follow the Money to PATH Stock

While UiPath offers a genuinely compelling business, specific challenges have kept a lid on its valuation. However, beyond the spotlight of the open market, professional traders have been buying up millions of dollars’ worth of net long call options. These calls can only be profitable if they reach defined thresholds, meaning that their acquisition could point to substantial upside for PATH stock.