On the surface, fast-casual restaurant operator Chipotle Mexican Grill (CMG) appears to be in serious trouble. Since the start of the year, CMG stock has been down about 32%. For context, the benchmark S&P 500 (SPX) is up over 15%. What’s more, peers in the broader fast-food industry — such as sector king McDonald’s (MCD) — have significantly outperformed Chipotle, which isn’t saying much.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This just goes to show what desperate straits investors find themselves in. However, for risk-tolerant options traders, CMG stock could be on the cusp of a reversal.

To be fair, circumstances don’t immediately suggest that upside is coming. Using fundamental analysis, for example, one could argue that CMG stock is trading at 28x forward earnings. While this metric is lower than the forward multiple of 46.73 posted at the end of June, relative valuation metrics are not universal truth claims. Just because a security is perceived to be at a “cheap” valuation doesn’t mean it can’t get any cheaper.

Technical analysts might point to a rising support line that began around mid-September. However, even here, concepts such as “rising support” are not universal truth claims. What we find in both the fundamental and technical approaches is that both the premise and the conclusion are contingent on the author.

If the expert’s guess is correct, the analysis is valid. If not, the report falls apart. Unfortunately, there’s no way to determine the likelihood that this person will issue a valid opinion at the time of publication, making both approaches incredibly flawed. While no methodology is perfect, the quantitative approach scratches the itch that no other analysis can.

Pivoting Away from Ego-Driven Analyses

By itself, contingency isn’t a problem. All projections about the unknown future are necessarily contingent. However, it’s unavoidable that if the premise rests solely on the person making the claim, the underlying analysis is ego-driven, thereby invalidating the core objectivity of the framework.

This is the main reason why technical analysis, in particular, has little credibility among many traders. The discipline depends on subjective pattern recognition: if a pattern isn’t perceived, the potential opportunity is effectively dismissed. Such dependence on individual interpretation makes for a fragile methodology.

In contrast, quantitative analysis is the study of pricing behavior to calculate forward probabilities, ultimately for the purpose of extracting potentially profitable trading ideas. While this methodology resembles the technical approach, the key distinguishing factor is falsifiability. In the quantitative framework, the premise is built on actual, empirical data. Thus, a hundred quants can identify the same pattern and come to the same conclusion.

Another essential element undergirding the quantitative approach is that its assumptions are based on real observations. Primarily, quants draw heavily on GARCH (Generalized Autoregressive Conditional Heteroskedasticity) studies, which describe volatility as a diffusive, clustering phenomenon rather than a linear, orderly mechanism. Stated differently, volatility today depends heavily on yesterday’s volatility.

As well, near-term catalysts have a far greater influence on current market behavior than those that materialized in the past. This is all common-sense stuff, which effectively states that different stimuli generate different forward behaviors.

Using simple rise-over-run-style formulations, it’s relatively easy to calculate the forward probabilities of a security under baseline conditions. With the quant method, analysts estimate the forward probabilities associated with a specific stimulus. This stimulus is the quant signal that the trader identifies.

Diving into the Potential Comeback Opportunity of CMG Stock

Now that we understand the quant approach, we can discuss the signal CMG stock recently flashed. In the past 10 weeks ending last Friday, CMG printed a 4-6-D sequence: four up weeks, six down weeks, with an overall downward trajectory. The actual sequence isn’t important per se. However, by tracking the projected 10-week returns associated with this signal, we can potentially extract a profitable options trade.

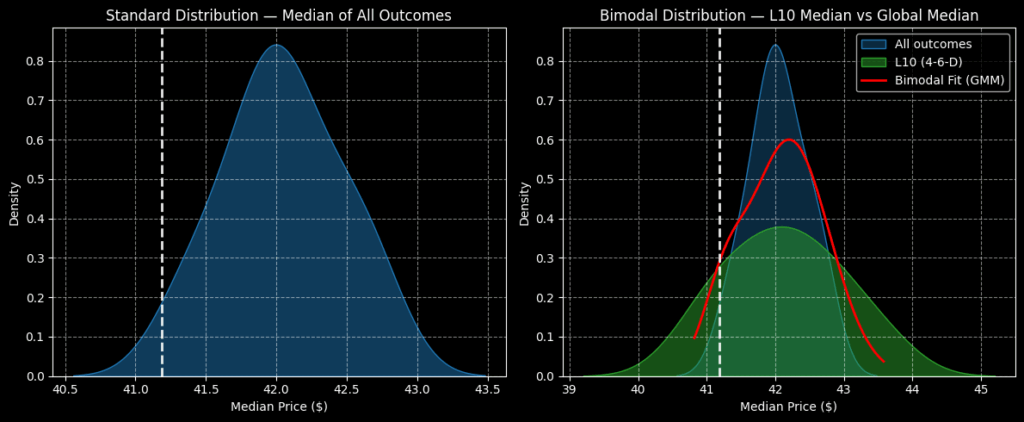

First, under baseline conditions, the forward 10-week returns follow a normal distribution, with median prices estimated to be between approximately $40.50 and $43.50 (assuming an anchor price of $41.19, Friday’s close). Price clustering would be expected to occur around $42.

However, my argument is that we’re not under baseline conditions but, instead, under the 4-6-D sequence. Given this particular profile, we can also expect price clustering over the next 10 weeks to occur around $42. However, the outer distribution tails expand to $39 on the risk side and to $45 on the reward side.

Given that the exceedance ratio is, for the most part, projected to remain above 50% over the next 10 weeks, the bulls appear to have an edge. Therefore, my assumption is that CMG stock will lean optimistically.

Those interested in speculating on Chipotle may consider the 41/43 bull call spread expiring November 21. This transaction involves buying the $41 call and simultaneously selling the $43 call, for a net debit paid of $99 (the most that can be lost in the trade). Should CMG stock rise through the second-leg strike of $43 at expiration, the maximum profit would be $101, representing a 102% payout.

Is CMG a Buy or Sell?

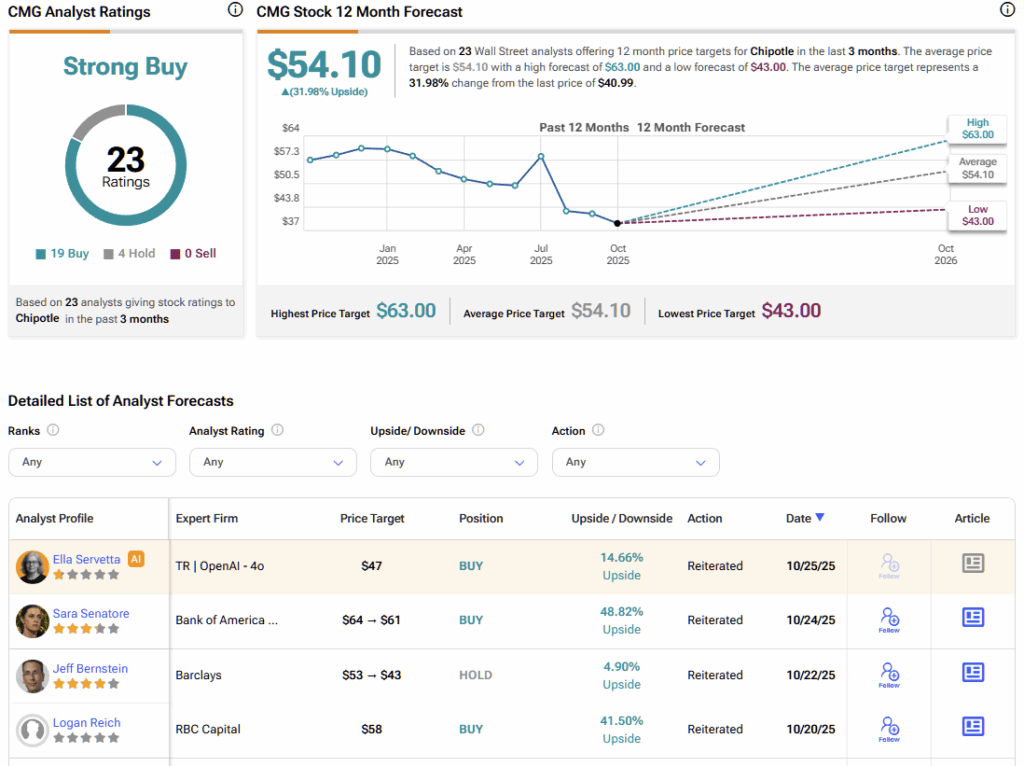

Turning to Wall Street, CMG stock carries a Strong Buy consensus rating based on 19 Buys, four Holds, and zero Sell ratings obtained over the past three months. Currently, the average CMG stock price target is $54.10, implying almost 32% upside potential over the coming 12 months.

Downtrodden CMG Stock is Poised for a Recovery Trade

Although fundamental and technical methodologies are widely used in financial analysis, they remain inherently dependent on the analyst’s perspective — and, in Chipotle’s case, overlook the underlying opportunity altogether. Only through quantitative analysis does the probabilistic outlook for CMG stock come into focus. With the data favoring the optimists, bold traders may find a bull call spread an appealing strategy to explore.