When War of the Worlds premiered this summer, moviegoers expected sci-fi warfare — not a masterclass in corporate co-op self-promotion. Yet beneath the special effects and explosions, something more deliberate and more strategic came into view. The evolution of “product placement 3.0” whereby firms merge product innovation, brand visibility, narrative ownership, and cross-platform integration into one seamless ecosystem of persuasion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For investors tracking the Magnificent 7 stocks: Meta Platforms (META), Amazon (AMZN), Microsoft (MSFT), Tesla (TSLA), Apple (AAPL), Alphabet (GOOGL), and Nvidia (NVDA) — the film serves as a vivid example of how today’s tech titans are reinventing the very meaning of advertising to extend their brands’ dominance.

New PR Playbook Includes ‘Narrative Integration’ Before Production

Traditional product placement was transactional: studios sold screen time, and brands bought visibility. In modern times, however, so-called product placement begins before the screenplay is finalized. According to industry chatter surrounding War of the Worlds, tech companies, including Meta, Apple, Google, Amazon, and Microsoft, were not simply approached after production; they were integral to the conceptual scaffolding.

From a stock investor’s perspective, this matters because not only do they have to conduct technical and fundamental analysis, but now, given how top-tier firms are leveraging public relations (PR), they’ll have to conduct in-depth sentiment analysis as well. Firms that can successfully embed their platforms into the DNA of popular culture don’t just gain impressions; they gain dependence.

Not to mention, stock resilience. In War of the Worlds, Meta’s WhatsApp and Facebook Messenger aren’t presented as mere accessories; they’re the communication backbone that keeps rescue teams connected when the world collapses. Amazon’s drone program isn’t just a plot filler; it’s the protagonist’s means of survival. Tesla’s autonomous driving and slick sensor detection aren’t simply comfy features, but rather, spectacular status symbols ready to rescue damsels in distress.

It’s what academic theorists call “narrative capital”: a concept that refers to the value, power, or advantage an organization gains by owning, shaping, or controlling a compelling story — especially one that others recognize and share.

Simple Reinforcement Goes a Long Way

Every time audiences see Tesla technology portrayed as lifesaving, it reinforces the company’s long-term positioning as an AI and robotics pioneer rather than merely an automaker. For Tesla shareholders, this is a crucial distinction. The company’s valuation already prices in expectations far beyond electric vehicles. Meanwhile, the automaker is currently being dragged through several courts for alleged defects, misrepresentations, or failures in its autopilot and full self-driving systems, as well as broader product liability claims over vehicle design.

By embedding Tesla into the film’s emotional core — a moment of rescue, trust, and salvation — the studio produces effective psychological conditioning that sustains investor confidence through cyclical turbulence. That degree of integration doesn’t happen by accident. It reflects a strategic convergence between entertainment and investor narratives, one that was almost certainly negotiated long before the first scene was shot.

Perception-Bending Media Stock Implications

For investors, this is less about box office figures and more about shaping consumer psychology at scale. If a billion-dollar sci-fi blockbuster can frame META as the communications lifeline of the modern world or Tesla as humanity’s technological savior, those impressions reverberate far beyond the movie theater.

In an era where brand sentiment directly translates into valuation multiples, tech giants have discovered that storytelling, not advertising, is their most efficient pathway to return on investment (ROI). Every shot that normalizes Facebook as infrastructure, every drone emblazoned with Amazon’s logo, every autonomous Tesla that rescues the innocent, functions as embedded investor relations.

This is how you reinforce a moat without overinflating the marketing budget or even appearing to market. It’s also how you keep investors emotionally tied to the stock because even the institutional ones can be just as susceptible to curated storytelling as the average Joe. When stock investors believe a brand is civilization’s backbone, they’re less likely to sell the stock when volatility arrives, as it most surely does with fast-growing tech stocks.

How The Magnificent 7 Weaves Its Story

Consider Meta. The company is currently embroiled in a high-stakes antitrust lawsuit by the FTC while facing fierce competition from TikTok and ongoing regulatory headwinds in Europe. Yet, by integrating its messaging ecosystem directly into War of the Worlds, Meta bypasses ad fatigue entirely. Instead of paying for short, expensive ads that many viewers skip, it weaves its value into people’s minds through storyline progression.

Amazon’s calculus is similar but broader. The company’s retail and cloud segments rely on constant cultural reinforcement of logistical supremacy. In War of the Worlds, when humanity depends on Amazon Prime’s drone delivery system to deliver a crucial device mid-invasion, the subtext is clear: Amazon isn’t just convenient, it’s essential infrastructure that everyone can depend on. Moreover, U.S. consumers are already witnessing Amazon’s delivery drones in action — a detail the movie cleverly spotlights as part of its save-the-day moment.

More subtle is Microsoft’s integration. The on-screen surveillance and hacking interface graphics closely resemble those of Microsoft Teams. Every visual cue associates Microsoft with national defense, data analysis, and continuity of government. Precisely the optics a trillion-dollar enterprise software firm wants as it competes for clients and federal contracts. A cynic would ask why Palantir Technologies (PLTR) wasn’t featured in the movie, although some of the systems used in the film do resemble its visuals.

These placements may seem incidental, but for investors, they point to multi-year brand architecture: a blending of entertainment, technology, and consumer psychology designed to keep the Magnificent 7 stocks at the top of every growth portfolio. Operating in a Trumpian America also carries advantages for the big seven.

The Temptations of Perception-Driven Stock Growth

In 2025, when an ambitious company seeks to bolster its image, it doesn’t just buy screen time or place products; it uses emotive storybuilding at a time when viewers are expecting ads the least – during a Hollywood movie. Each of the Magnificent 7 seeks to make its platforms seem like oxygen: invisible, omnipresent, and irreplaceable.

That’s why Meta isn’t promoting Facebook as a social media platform but as the backbone of crisis communications. Amazon isn’t delivering packages, but providing a mission-critical logistics grid. Microsoft isn’t peddling Office and Copilot; it’s demonstrating that its AI infrastructure underwrites planetary defense.

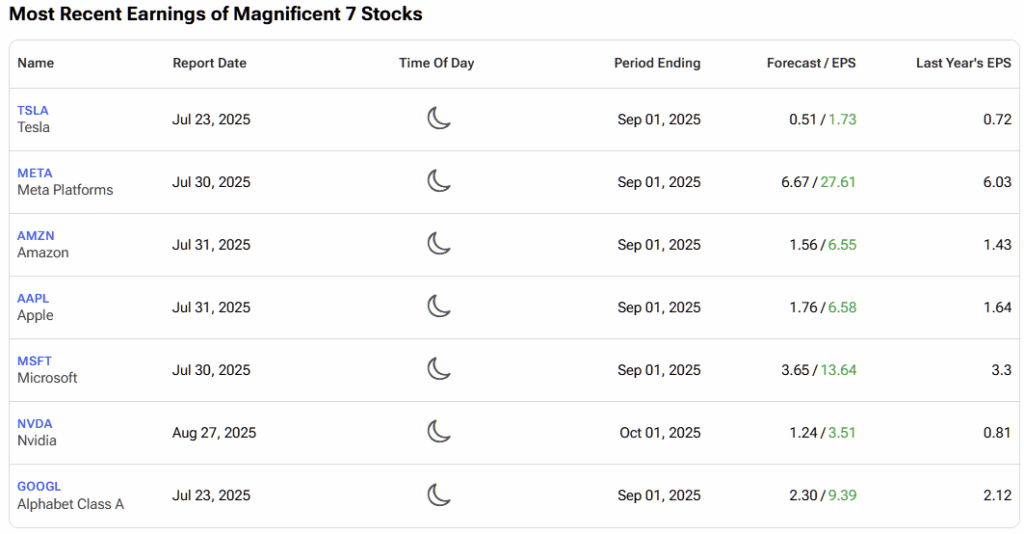

For investors, this strategy signals a shift toward perception-based valuation. The more a company can frame its technology as civilization-critical, the more defensible its market cap becomes, even when earnings growth slows. Not that such a slowdown seems likely anytime soon, according to recent earnings data.

Blowback Fails to Install Dire Consequences

Of course, reputational risks remain, as millions of disgruntled moviegoers see exactly what War of the Worlds actually is: a corporate tag-team marketing gambit that went a little too far. Others accuse the movie of crossing the line between cinema and shameless propaganda. If audiences start viewing these integrations as cynical manipulation rather than clever storytelling, backlash could emerge.

So far, however, that hasn’t materialized. Since the film’s release, all seven companies have hit record highs, without any boycotts or declines in “brand engagement.” Most viewers have dismissed the movie as a light, slapstick sci-fi romp that casts a shadow more on production value and execution than on its sponsors.

The main criticism has instead been directed at lead actor O’Shea Jackson Sr, colloquially known as Ice Cube, whose performance has drawn poor reviews. Meanwhile, producer Patrick Aiello maintains that the film’s eyebrow-raising and toe-curling branding moments were merely “happy accidents.”

Then there’s also the regulatory question. U.S. regulators could eventually scrutinize financial arrangements between studios and corporations, particularly if the intended goal is to influence investor investment decisions rather than provide entertainment.

Still, history suggests that outrage is transitory while brand memory is persistent. In the long run, the PR strategy behind War of the Worlds is poised to become a template for investor relations and public engagement — especially as generative AI makes personalized, immersive storytelling increasingly affordable and scalable.

Sculpting Culture to Sustain Brand Durability

This year’s Hollywood reboot of H.G. Wells’ 1898 cult classic novel won’t be collecting any Oscars, but it does offer a glimpse into how mega-cap companies are learning to defend their valuations in a market dominated by fragmented attention. The world’s most famous seven firms have learned that the next frontier of investor relations goes beyond the quarterly earnings call to become cultural storytelling that blurs the line between fantasy and reality.

When perception outpaces fundamentals, owning the story means owning the stock price, and as luck would have it, ‘The Magnificent 7’ have ensured that when the credits roll, their tickers still shine brightest.