To really drive home the irrationality of modern markets, consider that U.S stocks are currently at all-time highs during a government shutdown. As lawmakers in Washington spar over budget priorities, investors are weighing the potential impact of a U.S. government shutdown on U.S. stocks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

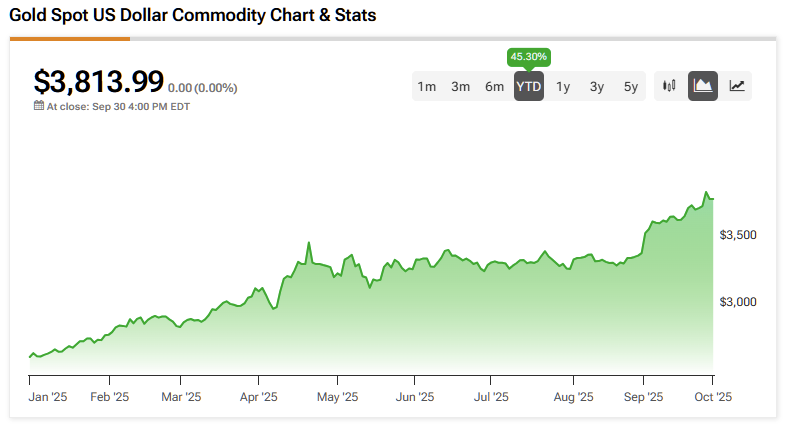

While the short-term economic consequences of a shutdown are likely to be limited compared to a prolonged standoff, the disruption is expected to leave noticeable marks across specific sectors of the stock market, prompting some investors to shift toward alternative assets, such as Bitcoin (BTC-USD) and gold (XAUUSD). Year-to-date, gold is up 45%.

The impact is already evident: Bitcoin has climbed 8% since Friday as risk appetite returned to the broader market, while gold touched an all-time high of ~$4,000/oz earlier this week. At the same time, healthcare and pharmaceutical stocks logged their strongest week in years, underscoring how investors may have grown more seasoned since the 35-day shutdown of 2018–2019. In other words, it appears that the investor community has shrugged off the shutdown with no hint of bearish corrections, as investors would typically expect.

Back in 2018, equity markets absorbed the disruption with only modest losses, as most participants bet on an eventual resolution. In 2025, traders appear to hold similar expectations, though with one key difference — today’s U.S. administration is actively channeling support into key sectors such as healthcare, defense, and information technology. History, it seems, doesn’t repeat, but it does rhyme.

Federal Contractors Face the Heaviest Pressure

The most immediate impact will be felt by companies dependent on federal spending. Defense and aerospace giants such as Lockheed Martin (LMT), Northrop Grumman (NOC), and General Dynamics (GD) rely heavily on government contracts that may be delayed or temporarily frozen.

Similarly, IT and consulting firms such as Leidos (LDOS), Booz Allen Hamilton (BAH), and SAIC (SAIC) could experience disruptions to projects and slower revenue recognition. Historically, shutdowns of a month or less have created temporary cash flow challenges but not long-term structural damage. Still, investors should expect volatility and possible 3–8% pullbacks in these names if headlines drag on.

Transportation and Housing Headwinds

Airlines are another group to watch. While essential staff, such as air traffic controllers, remain on the job, training, certification, and new regulatory approvals often halt during a shutdown. This can result in longer airport wait times, delayed fleet upgrades, and tighter scheduling. For airlines like Delta (DAL), United (UAL), and Southwest (LUV), a short disruption could modestly dent operations, but markets may still assign a risk discount. The housing sector could also experience turbulence.

Mortgage lenders and homebuilders rely on timely FHA and VA loan processing, which can slow to a crawl during a shutdown. Firms such as Rocket Companies (RKT), Lennar (LEN), and D.R. Horton (DHI) may experience a slight softening of demand if prospective buyers are forced to wait for loan approvals. The effect is unlikely to be catastrophic in a one-month window, but could sap momentum at a time when higher interest rates are already cooling the market.

Healthcare and Tech: Delays, Not Disaster

For healthcare and biotech firms, the Food and Drug Administration’s slowdown in reviewing new drug applications can create bottlenecks. A brief shutdown is more of a nuisance than a crisis, but small-cap biotech companies with pending approvals may face heightened volatility.

Big tech firms, such as Amazon (AMZN) and Microsoft (MSFT), which supply cloud services to federal agencies, are far more insulated. Their long-term contracts remain in place, though new deals could be delayed. Over a short horizon, this is unlikely to significantly dent earnings, but it may contribute to broader investor caution.

Bitcoin’s Hedge Role Grows

Beyond equities, alternative assets deserve attention. Gold has long been a traditional safe haven during fiscal and political uncertainty, and its role remains intact. However, Bitcoin is increasingly viewed by some investors as a modern hedge against U.S. fiscal dysfunction. It seems the unthinkable has finally happened — a digital cryptocurrency becoming a safe-haven reserve, at least in people’s minds.

Recent cycles have demonstrated that Bitcoin can attract inflows during periods of shutdown fears, government debt debates, and market volatility. While the asset remains highly volatile, its narrative as “digital gold” is gaining traction, particularly among younger investors.

Markets Shrug Off Shutdown Turbulence Without Panic

If the shutdown duration is no more than 35 days, as in the previous one, the overall market should be able to absorb the disruption without incurring significant long-term damage. The S&P 500 could experience short-term weakness, driven by defense, aerospace, and housing-related names, while safer assets, such as gold and, increasingly, Bitcoin, benefit from a flight to perceived stability. For now, markets appear to be bracing for turbulence, but not panic, as investors focus on sector-specific risks and alternative hedges.