Tesla (TSLA) shareholders are preparing to vote on a compensation plan that could hand CEO Elon Musk one of the biggest pay packages in corporate history, and possibly make him the world’s first trillion-dollar executive.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It’s a Giant Bet on One Man

Tesla’s board has proposed a new performance award that would grant Musk about 425 million shares if he meets a set of steep financial and operational milestones over the next decade. If all targets are hit and Tesla’s market value climbs to $8.5 trillion, the package could be worth $1 trillion.

Coming into this week, Tesla is valued at roughly $1.4 trillion. If the stock compounds around 20% a year for the next ten years, Musk could reach that target.

Santa Clara University professor Jo-Ellen Pozner highlighted the scale of it all:

“It’s just a matter of ego and an assertion on the part of Elon Musk of what he deserves. A trillion is the new billion.”

The Roadmap Behind the Reward

To unlock the payout, Tesla must hit both financial and operational goals. The company needs to reach $400 billion in annual Ebitda, up from about $13 billion expected in 2025. Operationally, it must sell 20 million electric vehicles, reach 10 million subscriptions for its Full Self Driving software, deploy one million robo-taxis, and sell one million robots.

Selling cars looks achievable. Tesla has already sold roughly 8.5 million vehicles since inception. But the other targets hinge on major advances in artificial intelligence, which is the technology Tesla hopes will train cars to drive themselves and robots to work alongside humans.

Analysts Expect the Pay Package to Pass

Most analysts and investors believe the plan will pass easily. Tesla shareholders have approved Musk’s previous mega-pay packages in 2012 and 2018, even when proxy advisory firms recommended voting against them.

Musk, as usual, didn’t hold back. In October, he called those proxy advisors “corporate terrorists.”

Wall Street sees the plan’s structure, all performance-based with no guaranteed salary, as defensible. If Tesla’s stock doesn’t rise, Musk earns nothing.

How Tesla’s Board Works in Musk’s Favor

Still, the vote has revived debate about Tesla’s board and governance. Critics say the board isn’t truly independent. Pozner said, “He’s created a board, and a governance scenario, where there’s nobody who’s going to say no to him.”

Whether Musk is “worth” $1 trillion is almost beside the point. To many investors, Tesla is Musk. They see the company’s growth, innovation, and market value as direct reflections of his drive. This is why they believe his incentives should match that ambition.

What Does this All Mean Going Forward?

If the package passes, it will signal that shareholders want Musk focused on scaling Tesla into a multi-trillion-dollar AI and robotics powerhouse. Reaching those milestones would justify the $8.5 trillion valuation target, but missing them would leave most of the award on paper.

The bigger question is whether this vote sets a new precedent for executive pay. Pozner thinks not.

“He’s one of one,” she said. And even his critics agree with that.

Is Tesla Stock a Buy, Hold, or Sell?

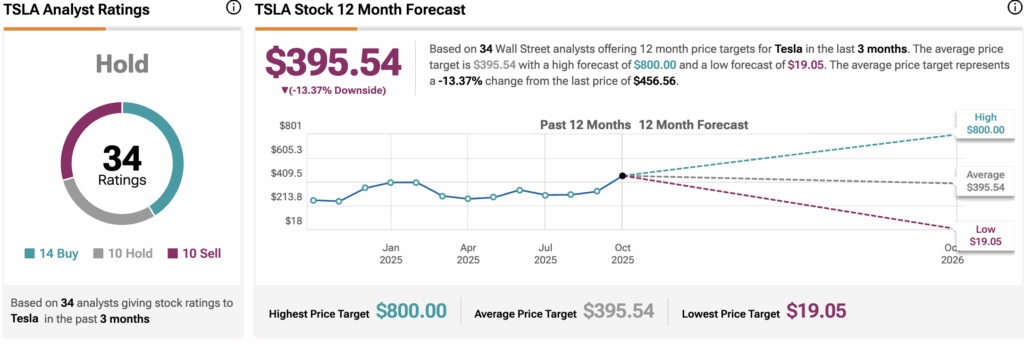

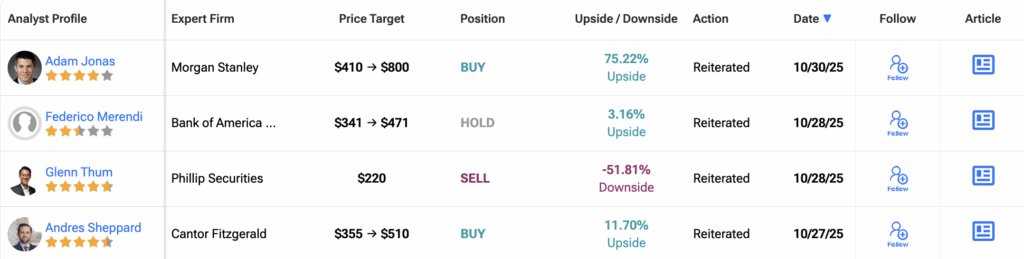

According to TipRanks data, Wall Street analysts are divided on Tesla’s near-term prospects. Out of 34 analysts, 14 rate the stock a Buy, 10 call it a Hold, and 10 recommend a Sell. This split gives Tesla an overall Hold consensus rating.

The average 12-month TSLA price target stands at $395.54, which suggests a 13% downside from the current price.