On the surface, video-sharing platform Rumble (NASDAQ:RUM) – a woke-free YouTube alternative, if you will – garnered plenty of headlines for effectively attempting to buy out TikTok, the short-form video app that has been causing a legislative firestorm. However, the real focus should be on Rumble’s potential for quick profit generation for shrewd day traders. I am bearish on RUM stock because it currently features a downtrend that can be exploited by politically agnostic market participants.

RUM Stock Soars Higher Amid TikTok Drama

As TipRanks contributor Steve Anderson mentioned, when news started circulating that TikTok might be banned in the U.S., a few notable voices offered to buy the platform. Such overtures made perfect sense. In September 2021, the video-sharing app reached one billion monthly active users (MAUs) worldwide. Obviously, that’s a massive footprint, enabling the owner to wield considerable influence.

For context, Rumble’s MAUs number almost 60 million on average. That’s not bad considering the limited niche market, which is basically conservative viewers distrustful of big tech censorship protocols. Should Rumble take over U.S. TikTok operations, the move would theoretically lend a dramatic credibility boost to the platform.

Given the upside possibility, RUM stock soared on Rumble’s offer to “serve as a cloud technology partner” with TikTok. It shot up again when the U.S. House of Representatives passed a bill that would put the clock on the app’s owner, China-based ByteDance. The measure gives the company about six months to divest the U.S. assets of TikTok or face a ban.

Nevertheless, the bill would also need to pass the Senate, which may be problematic. Also, even if the upper legislative chamber agrees, the measure will almost certainly face constitutionality challenges. That leaves the investment narrative of RUM stock in doubt. However, it’s an appealing day trading opportunity.

Run the Math on Rumble

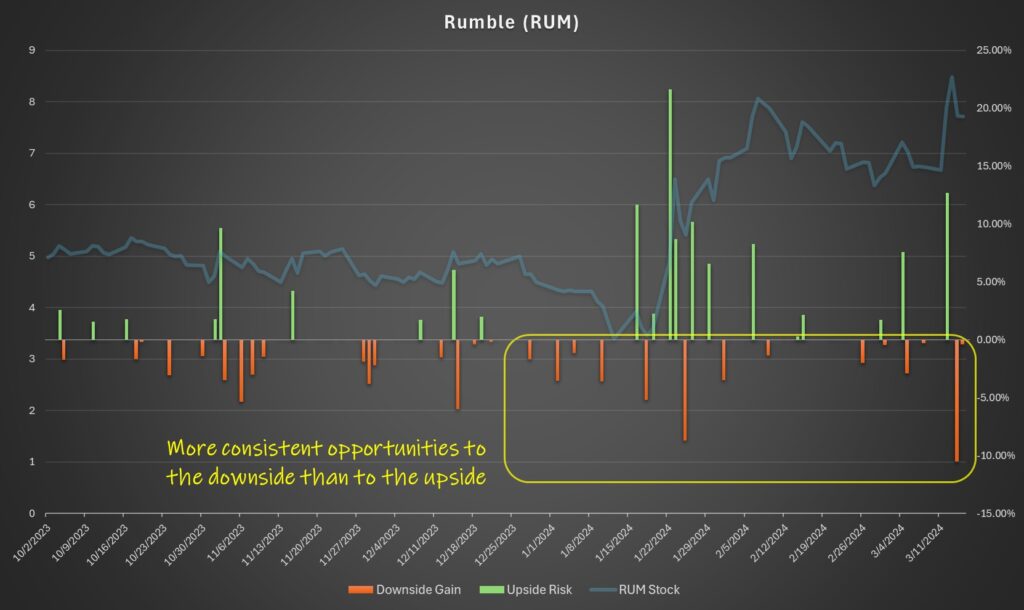

In particular, RUM stock (so far) features a consistently downward bias. Because of this trend, traders can use this dynamic to their advantage to extract short-term profits.

Since the beginning of October last year through last Friday, there have been 115 trading sessions. Within this total, 52 sessions saw the opening price open higher than the prior day’s session, while 63 “openers” were negative.

Now, 31 times (59.62%) when the opener was positive, the session eventually ended lower. Further, 37 times (58.73%) when the opener was negative, the session also ended lower. In other words, over the past several months, RUM stock has clearly demonstrated a downward bias.

Knowing this framework, traders can potentially take advantage of this data for quick profits. Basically, if RUM stock opens a session higher than the prior day’s closing price, there’s a 60% chance that the session will end up in the red. Conversely, there’s a 40% chance that the session will end up in the black, presenting an upside risk to the bearish trader.

So long as this framework generally holds, traders may be able to place multiple bets against RUM stock; that is, buying a put option at the beginning of the day, closing it out at the end, and repeating the process the next day.

Of course, the framework must not change – otherwise, you’d be taking significant losses. So far, though, the downward bias of RUM stock offers an attractive canvas for trading tactics.

Risks and Rewards

Before you jump aboard the opportunity in RUM stock, you must be aware that, mathematically, this is a race between frequency and magnitude.

In the specific framework that I mentioned, when the opener starts positively, the odds favor a downside move of 60 to 40. Therefore, buying a RUM stock put option makes sense. However, the average downside move under this framework (since the beginning of October) is 2.67%.

On the other hand, a positive opener only yields a 40% chance that the session will end up profitable for the day. However, when it does end up in the black, there’s a good chance that the swing higher is robust. Indeed, the average upswing (since the beginning of October) is 5.96%.

Therefore, trading RUM stock—even with the bears’ statistical advantage—is still difficult. One needs to be incredibly disciplined to cut losses when the trade isn’t going favorably. Otherwise, RUM has demonstrated that it can devastate bears when the stars happen to align.

If there’s a wrinkle to this narrative, it stems from the political drama. For example, if the Senate doesn’t pass the bill, TikTok should be safe from a possible ban. In that case, the short-form video app operator wouldn’t need a cloud technology partner. If so, RUM stock may see fewer robust upswings and more powerful downswings.

That should favor the bears, but it’s an area that still requires careful thought.

The Takeaway: RUM Stock Presents an Enticing Trading Opportunity

Trouble for TikTok’s U.S. operations has led to a few notable calls for suitors, including Rumble. However, the complex legislative and political narrative makes an outright ban unlikely. Therefore, RUM stock will likely continue forward with its downward bias. So long as this negative framework holds up, it’s possible for bold, bearish day traders to extract multiple short-term profits.