Tech giant IBM (IBM) has developed a powerful AI system to help Norway’s railroad agency, Bane NOR, detect early signs of track damage using photos. Traditionally, rail workers walk along the tracks to spot visible issues, which is time-consuming and not always reliable. However, IBM’s system, combined with its Maximo software, now automates that process. Indeed, it can recognize 10 types of common defects in rails, sleepers (the horizontal supports), and fasteners.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This allows experienced workers to focus more on fixing problems rather than spending time doing inspections, while helping Bane NOR spot issues before they become dangerous. Interestingly, though, training the AI model wasn’t easy because Norway’s rail system is in such good shape that actual defect examples were rare. To solve this, IBM and Bane NOR engineers worked together to label images showing even small flaws. The final result is a smart tool that not only spots defects but also monitors them over time, thereby giving inspectors a clearer view of which areas need attention.

Furthermore, IBM has now included this feature in the latest version of its Maximo Civil Infrastructure software. In fact, the system is already being tested using high-resolution images taken from special carts that travel along the tracks. IBM is also helping Bane NOR shift to reviewing images in-house instead of relying on outside vendors, which gives them more control and faster results. Over time, Bane NOR hopes this AI technology will help them stay ahead of maintenance delays and avoid serious track failures.

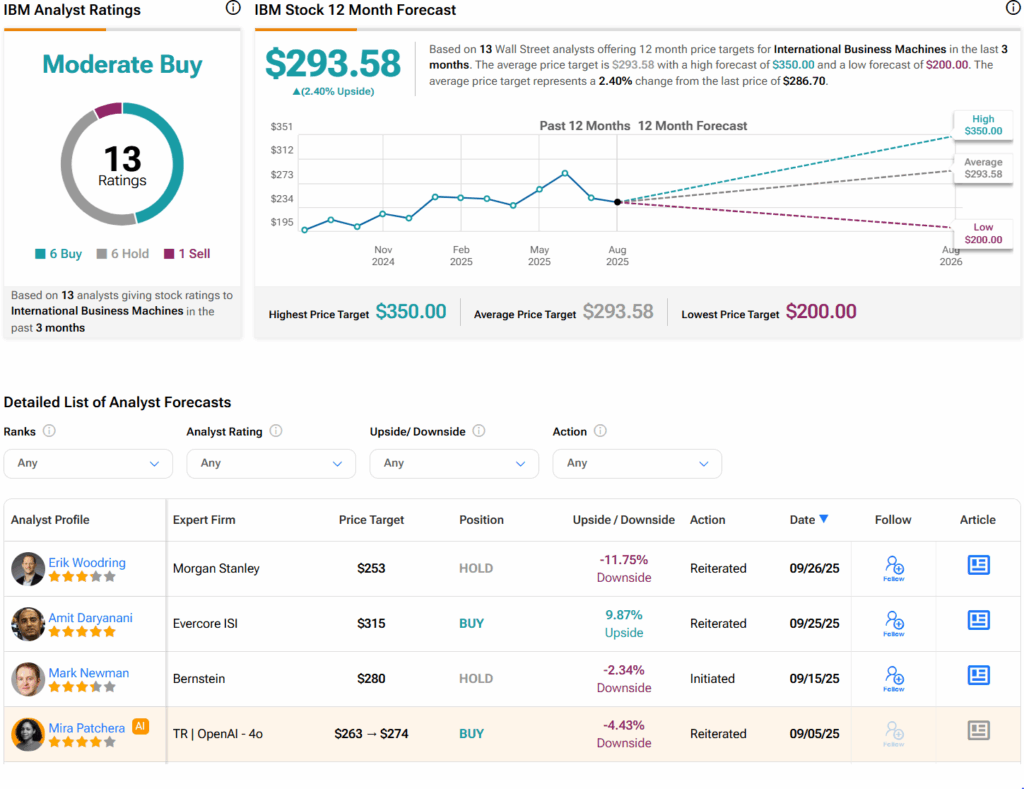

Is IBM a Buy, Sell, or Hold?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on IBM stock based on six Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average IBM price target of $293.58 per share implies 2.4% upside potential.