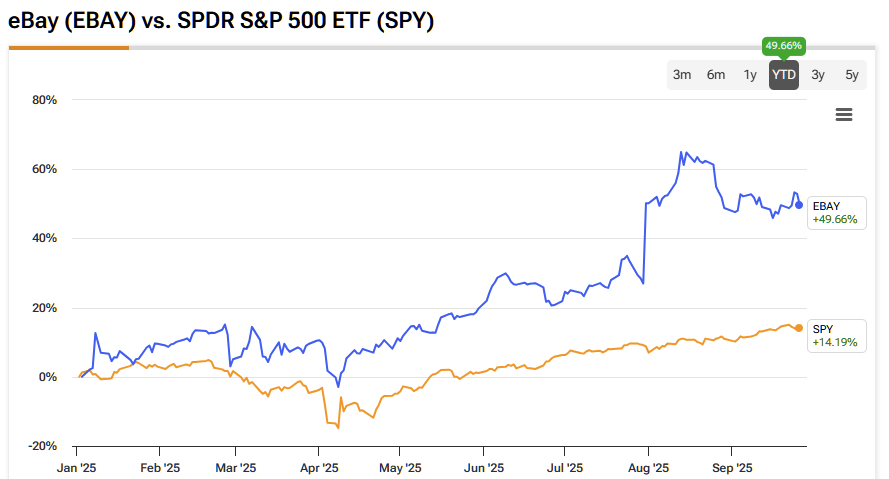

With AI-focused stocks dominating headlines in 2025, it’s easy to dismiss an old-school internet name like eBay (EBAY)—founded back in 1995—as “yesterday’s news.” Yet the stock is up nearly 50% year-to-date and still has room to run. In fact, chart data indicates that eBay is on a multi-year uptrend, while becoming more than just a household name; the brand has become ubiquitous with trading everyday items — an activity that’s likely to flourish in a tech-driven modern world, with more people connecting to the Internet and tapping into e-commerce.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

I’m Bullish on eBay thanks to its innovative use of AI to boost platform activity, its attractive valuation, a modest but growing dividend, and consistent buybacks that reward loyal shareholders.

To really drive home the point about loyalty. According to total return data on eBay with dividends reinvested, an initial investment of $10,000 in eBay at its original IPO in 1998 would now be worth approximately $1.22 million.

What is eBay?

Founded 30 years ago as AuctionWeb, eBay has been around since before the dotcom bubble and predates many of today’s popular internet and technology stocks. It is an online marketplace where users sell items to customers, either via auctions or direct sales. eBay describes itself as “a global commerce leader that connects millions of buyers and sellers around the world” in 190 markets.

It’s a simple and effective business model; eBay doesn’t hold any inventory or fulfill logistics, it simply provides a marketplace for buyers and sellers to connect and transact. This asset-light business model translates to attractive 72% gross margins.

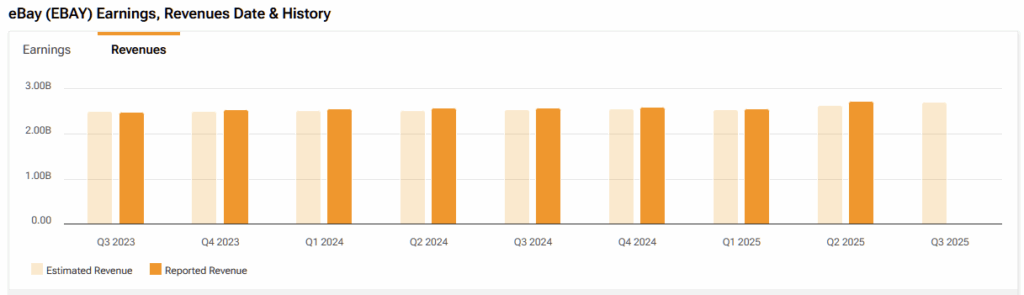

The business is quietly chugging along and posting solid results. During Q2 2025, gross merchandise volume (GMV), the total dollar amount of all items sold on the platform, a key metric for eBay, chugged 6% higher year-over-year to $19.5 billion, while earnings per diluted share surged from $0.45 last year to $0.79 this year.

Old Dog, New Tricks

eBay is best known for its roots in collectibles. In the 1990s, the platform’s early boom was fueled by users trading popular items, such as Beanie Babies and Pokémon cards.

Despite this connotation, eBay is hardly a relic from the dawn of the internet. The platform is still quietly growing today, effectively utilizing AI to strengthen its business, proving that you can teach an old dog new tricks. Its AI-powered Magic Listing feature enables consumers to list items simply by taking a picture of them with their phones. Magic Listings can then recognize and write a description of the product, and leverage eBay’s trove of pricing data built up over three decades to suggest pricing. Over 10 million users have now utilized the AI-enabled tool to list more than 200 million products on the platform.

eBay is leveraging AI to deliver more relevant listings and recommendations to buyers while optimizing advertising for sellers. In Q2, advertising revenue rose 17% year-over-year to $455 million. Ultimately, all of eBay’s successes will in some way be tied to the number of active buyers on its platform. As of the last count, eBay is attracting ~140 million users, per TipRanks data.

The company is also deploying generative AI to refine product titles and descriptions, improving visibility and performance on Google. In addition, eBay’s proprietary large language models power millions of personalized weekly emails—featuring product suggestions, abandoned cart reminders, and updates from followed sellers—further boosting engagement and conversion.

eBay Runs at a Discount to the Market

Even after its strong year-to-date rally, eBay still looks attractively priced. Shares trade at less than 17x 2025 earnings estimates—well below the S&P 500’s ~22.5x multiple. This discount suggests the stock’s gains haven’t been driven by excessive froth, leaving room for further upside if the company continues to execute and deliver solid results. In the meantime, the stock has already been outperforming the S&P 500 (SPX) since April.

Quiet Dividend Growth Stock

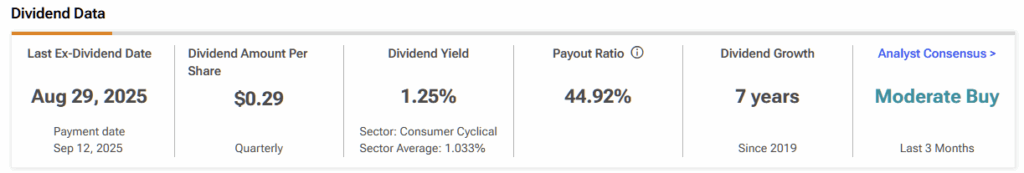

In addition to its attractive valuation, eBay has also established itself as a dividend payer, having initiated a payout in 2019. The current yield of 1.25% aligns with the S&P 500 average, and the company has increased its dividend every year for the past five years, establishing a reputation as a steady dividend growth stock.

eBay is further enhancing shareholder value through buybacks. In Q2 2025 alone, it repurchased $625 million of its own stock. By reducing the number of shares outstanding, these repurchases increase earnings per share and concentrate returns among the remaining shareholders.

Is eBay a Good Stock to Buy Today?

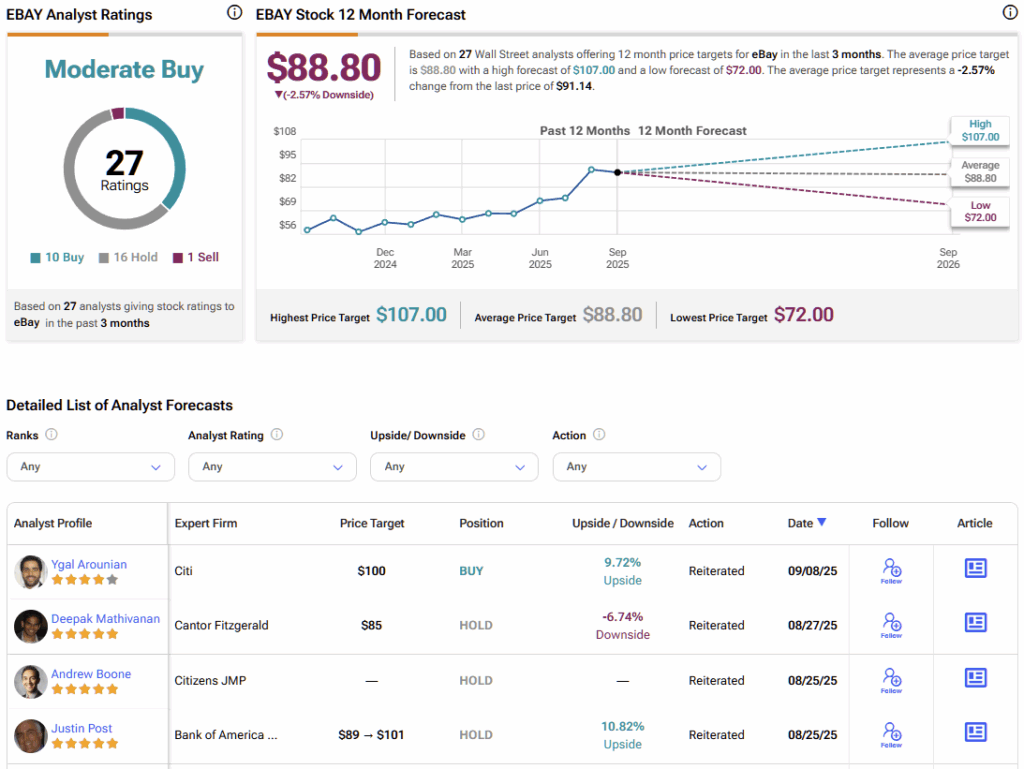

Turning to Wall Street, EBAY earns a Moderate Buy consensus rating based on 10 Buys, 16 Holds, and one Sell rating assigned in the past three months. The average EBAY stock price target of $88.80 implies 2.6% downside potential over the coming twelve months.

eBay’s AI Edge, Dividend Growth, and Buybacks Seal the Deal

I remain Bullish on eBay. Despite a nearly 50% year-to-date gain, the stock remains compelling at just under 17x 2025 earnings estimates. eBay is effectively leveraging AI to enhance its marketplace for both buyers and sellers, driving growth in GMV. Combined with its reasonable valuation, a steadily rising dividend, and aggressive share repurchases, eBay offers an appealing setup for continued upside.