Home Depot (NYSE:HD) is grappling with a slowdown in growth. The hardware haven for DIY enthusiasts and contractors reported declining revenues in FY 2023, a trend not seen since the Great Financial Crisis of 2007-08. Looking ahead to FY 2024, Wall Street anticipates another year of subpar growth. While this setup may raise worries about Home Depot’s rising share price, there’s a sense of optimism in the market regarding a potential rebound in financials from FY 2025 onwards. Thus, I am bullish on the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

FY2023: Worst Sales Development Since the Great Financial Crisis

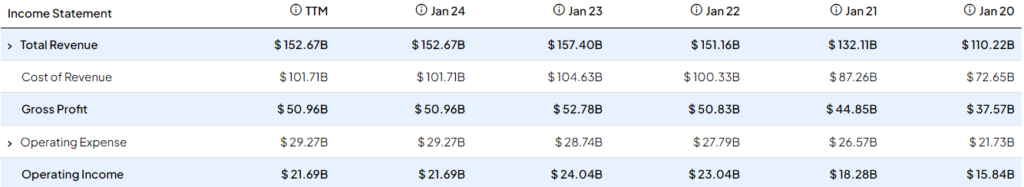

In FY 2023, Home Depot posted its worst sales growth (or lack thereof) since the Great Financial Crisis. Total sales were $152.7 billion, down 3% compared to FY 2022. This comes after 13 consecutive years of sales growth. The last period of declining revenues occurred between 2007 and 2010, coinciding with a lower demand for DIY and renovation products due to the collapse of the housing market.

Although the interruption of such a longstanding growing sales trajectory may initially trigger concerns, I believe that investors can view this as a natural progression in Home Depot’s overall sales development, provided the right context is considered.

Firstly, it’s important to recognize that Home Depot experienced a massive sales surge in the three years leading to FY2023, making a subsequent step back inevitable. To illustrate, between 2020 and 2023, Home Depot achieved a 12.6% compound annual growth rate (CAGR) in sales, surpassing its past growth rates. To put this in perspective, its revenue CAGR for the preceding decade (2010-2020) was a modest 5.2%, even during a notably bullish period in the residential real estate market.

Therefore, given the abnormal uptick in revenue growth in recent years, largely fueled by a surge in home improvement projects during and post-pandemic, a year of moderation shouldn’t come as surprising. In particular, on top of the post-pandemic home-improvement trend normalizing, Home Depot’s numbers were impacted by a tough macro environment.

FY 2023 was a period of four Fed funds rate increases, a sharp drop in existing home sales, and roughly 110 basis points of “comp pressure from lumber deflation,” according to the company.

FY 2024: Subpar Growth Expected, But a Positive Trajectory Is Forming

Home Depot’s growth is expected to remain subpar in FY 2024 as challenges persist. Interest rates remain high, keeping the residential real estate market quiet. Therefore, the demand for home renovation and DIY products is expected to remain restrained. Further, personal consumption growth, as calculated by personal consumption expenditures, is also anticipated to decelerate relative to 2023.

Nevertheless, Home Depot’s sales growth trajectory is expected to turn positive this year. Management stated that even though the home improvement market still faces headwinds, as just mentioned, they feel optimistic moving into the year as there are signs that the economy is on the way toward normalization. Other positive contributors to FY 2024 sales should be a 53rd week included in the period, the acquisitions Home Depot made, the new stores it opened last year, and the 12 new stores expected to open in 2024.

One of the more noteworthy acquisitions was that of Construction Resources, a distributor of surfaces, appliances, and architectural specialty products praised for their unique designs. Home Depot is going to market these to Pro contractors that concentrate on renovation, remodeling, and residential homebuilding. The buyout took place last December and is expected to expand the company’s addressable market and positively contribute to sales growth.

As a result, even though management expects a 1% decline in same-store sales growth, total sales growth for the year is expected to turn positive, at about 1%, and initiate a multi-year rebound from there.

Financials to Get Stronger in FY 2025

From FY 2025 onwards, the market anticipates that Home Depot will overcome the majority of headwinds currently hampering its growth trajectory. This aligns with the market’s view of possible rate cuts, whether they occur this year (a scenario that has faded away recently due to the economy remaining hot) or next year.

To illustrate, while Wall Street expects that revenues will grow by about 1% in FY2024, matching Home Depot’s own outlook, revenue growth is expected to rebound to 2.6% in FY 2025 and 4.0% in FY 2026. In terms of EPS, Wall Street sees growth of 1.9% to $15.39 this year. But again, growth is also anticipated to pick up after that, with Wall Street seeing EPS growth of 7.1%, 8.9%, and 9.4% in FY 2025, FY 2026, and FY 2027, respectively.

Given a strong EPS growth rebound over the medium term, likely to converge in the high-single digits, the stock’s strong rally over the past year can be attributed to investors already pricing in this outcome, which appears like a reasonable action. After all, trading at 25x this year’s expected EPS, I don’t see the stock as particularly expensive, given its moat, qualities, and long-term growth prospects — assuming, though, that interest rates actually ease in the coming quarters.

Is HD Stock a Buy, According to Analysts?

As far as Wall Street’s view on the stock goes, Home Depot features a Moderate Buy consensus rating based on 18 Buys, seven Holds, and two Sell recommendations assigned in the past three months. At $381.35, the average Home Depot stock forecast suggests 0.7% downside potential, nonetheless.

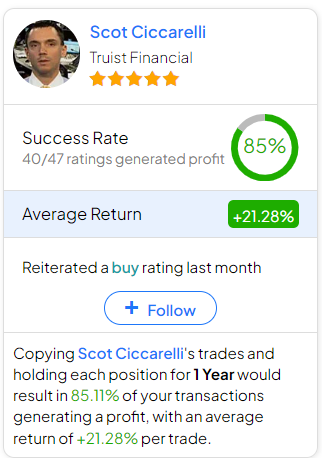

If you’re wondering which analyst you should follow if you want to buy and sell HD stock, the most profitable analyst covering the stock (on a one-year timeframe) is Scot Ciccarelli from Truist Financial, with an average return of 21.28% per rating and an 85% success rate.

The Takeaway

To sum up, Home Depot’s recent sales downturn in FY 2023 marked a deviation from its historical growth trajectory. However, this seems to be a natural progression following three years of abnormal expansion.

While FY 2024 is anticipated to present continued challenges, including subpar growth, signs of a trend reversion are on the horizon. In FY 2024, new store openings and new sales from Construction Resources should contribute to the top line, while FY 2025 should mark the start of a reacceleration in Home Depot’s overall financials.

With the market likely correctly pricing an optimistic medium-term outlook for the company, I don’t see the stock’s prolonged rally over the past year as unjustified.